Key electric vehicles (EV) battery material lithium has consolidated after minor correction in June-July and its prices are likely to rule at elevated levels for the remaining part of the year.

The outlook for lithium is seen as strong on increasing sales of EVs in the first half of this year and a surge in prices of petroleum products, particularly after the Ukraine war broke out.

Prices of lithium carbonate, from which lithium is extracted, have increased over 70 per cent since January this year to 4,76,500 Chinese yuan ($70,761) a tonne from 2,77,207 yuan. In March this year, it had topped a record high of 5,00,000 yuan, while year-on-year, it has surged over four times.

Govt sops too drive sales

Currently, a 63 per cent rise in global EV sales to 4.2 million units is driving the metal’s prices up. Of the 4.2 million vehicles, both battery EVs and plug-in hybrid EVs, China has accounted for 57 per cent.

Trade analyst firm Canalys said besides rising fuel prices, continued government incentives are driving the growth in EV sales.

In India, too, EV sales are witnessing good growth. According to the Ministry of Road Transport and Highways, EV sales are up three times year-on-year at 3.9 lakh.

Investing News said the June sales figures for EV sales in China indicated a significant recovery after the Covid lockdown was lifted in Shanghai. It resulted in “record-breaking production and sales”, it said.

Research agency Fitch Solutions Country Risk and Industry Research, a unit of Fitch, said lithium has been driven higher by strong automotive demand in Europe, China, and the United States.

Demand to continue in Q3

“These price pressures were exacerbated by the relatively illiquid market for lithium spot trading. There has effectively been no open interest or volume on lithium hydroxide futures contracts launched by the Chicago Mercantile Exchange and London Metals Exchange to allow firms to hedge price volatility by accepting future deliveries,” it said.

Manufacturers scrambled to meet past and existing orders and saw little value in buying futures contracts when there was little confidence that future supply would be there to deliver, the research agency said.

Investing News, quoting analysts, said demand from the EV sector will continue in the third quarter, provided there are no further strict lockdowns that could affect production. “We expect broad lithium prices to remain extremely elevated through 2022 and beyond due to stronger than expected battery and electric vehicle demand and lagging supply despite the shortening of many project timelines, as accelerating demand for lithium-ion batteries and a tight upstream supply keep prices elevated,” Fitch Solutions said.

Price forecast

This goes well with the UK-based Benchmark Mineral Intelligence forecast of a deficit in lithium this year.

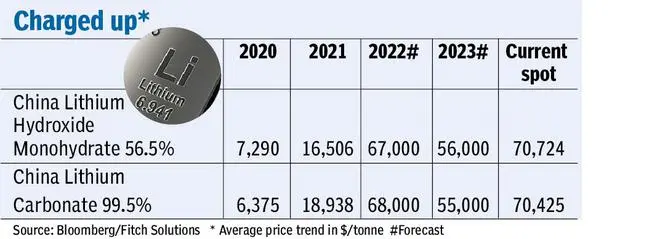

Fitch Solutions has forecast Chinese lithium carbonate 99.5 per cent to average $68,000 a tonne this year and $55,000 in 2023. Chinese lithium hydroxide monohydrate 56.5 per cent prices are likely to average $67,000/tonne in 2022 and $56,000/ tonne in 2023.

Investment bank Goldman Sachs has forecast lithium prices to correct lower to $54,000 this year from over $60,000 and next year, the rare metal is expected to average a little over $16,000.

Goldman Sachs said it is not forecasting that the long-term bull market in lithium is over. The drop is a temporary phase with the lithium market moving back to a supply deficit by 2024.

One bright spot for lithium is that EV sales in China are likely to double this year to about 6.5 million from last year. The market is also heading to a tight supply situation as only limited new lithium projects are likely to come online.

Fitch Solutions, quoting its database of global lithium projects, said only four mines with an expected capacity of approximately 75,000 tonnes were due to come online this year. “Next year, we expect at least 11 projects to begin production while demand continues to rise,” it said.

Demand boosters

“In the longer term, lithium prices are likely to be impacted by green premiums due to heightened priority of sustainable lithium extraction techniques,” Fitch Solutions said. A faster-than-anticipated advancement in battery recycling technology poses a risk to lithium prices by significantly expanding the sustainable lithium supply.

Lithium, a light metal that can store large amounts of energy and an excellent conductor of electricity, is a key component in the production of EVs that rely on lithium-ion batteries for power. This has resulted in an over 20 per cent growth in the metal’s demand. Global efforts to decarbonise and turn to green power are boosting forecast demand for EVs.

In terms of supply, Chile has the world’s largest known lithium reserves with 8 million tonnes (mt). Australia has 2.7 mt, Argentina has 2 mt and China is known to have one mt.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.