The outlook for coating metal zinc is bearish on increase in smelter supply, weak demand, and Chinese curbs on steel production, analysts have said.

Zinc, used mainly as coating to protect steel and iron, has dropped to near two-year low and is currently trading at $2,328 a tonne on the London Metal Exchange (LME) for three-month contracts. Spot zinc is quoting at $2,331.50.

Zinc prices have dropped over 20 per cent in 2023 with LME-registered inventories nearly doubling to a 12-month high.

The decline in zinc prices has resulted in research and rating agencies such as BMI, a unit of Fitch Solutions, and Goldman Sachs to lower their prices outlook for the metal.

H2 price projection

“We have revised down our average zinc price forecast for 2023 from $3,000/ tonne to $2,550. This implies an average price of around $2,275 over June-December 2023,” BMI said in its outlook.

Goldman Sachs has shifted its outlook to a bearish one, projecting an oversupply this year. The Office of Chief Economist, Australia, had earlier this year forecast LME zinc spot price to average around $3,100 a tonne in 2023. However, it sees prices falling gradually to $2,600 by 2028.

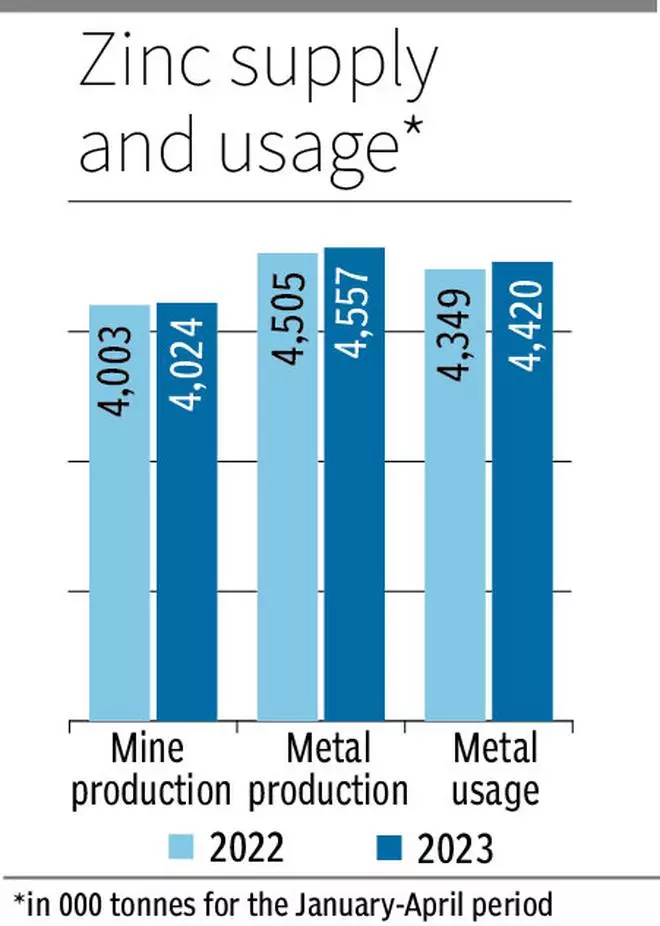

According to data from the International Lead and Zinc Study Group (ILZSG), the global market for refined zinc metal was in surplus by 138,000 tonnes in the first four months of 2023 with total reported inventories increasing by 58,000 tonnes.

World zinc mine production rose by a marginal 0.5 per cent and refined metal production was up 1.2 per cent with China being the main driver of the rise.

Slow Chinese recovery

ING Think, a financial and economic analysis unit of Dutch financial services firm ING, said on-warrant stocks rose earlier this month by 13,775 tonnes (the biggest daily addition since December 2021) to 81,825 tonnes (the highest since 1 April 2022).

Net inflows in May totalled 34,950 tonnes compared with the inflows of 4,175 tonnes in April, it said.

Analysts said the Chinese demand is recovering at a slower pace than initially anticipated. However, Chinese producers are increasing their production after absorbing surplus concentrates.

BMI said zinc demand in Mainland China will likely slow over June-December 2023 due to curbs on steel production. “Steel production in the country will need to contract year-on-year over June-December 2023 in order to meet the government’s target for the year as a whole,” it said.

Refined metal usage

The Australian Office of the Chief Economist said zinc demand was expected to rebound as China’s economy was expected to pick up pace and energy prices might ease.

ILZSG said increases in the usage of refined zinc metal in China, India, and the US were partially offset by reductions in Europe, Brazil, the Republic of Korea, Taiwan (China), Thailand, and Turkey. This resulted in an overall global rise of 1.6 per cent.

BMI said there are tentative signs that European smelters could begin increasing production again in 2023. “In February 2023, Nyrstar restarted production at the firm’s Auby plant in France, having previously been placed on care and maintenance in 2022 due to high power costs,” it said.

Zinc mine production will continue to expand gradually over the coming decade despite declining prices over the period. Australia, India and the US will be responsible for most of this output growth, the research agency said.

Negative going forward

The Office of Chief Economist said Australia’s zinc production is forecast to rise by 2.5 per cent per year to around 1.5 mt by 2027–28. High prices have encouraged strong exploration expenditure, which will support long run production growth, it said.

BMI painted a negative picture for zinc beyond 2023 as well. “...our long-term view on zinc prices remains negative, and we have revised down our average price forecasts. We now forecast a steeper downtrend in zinc prices to average $2,150/tonne over 2024-2027, compared to our previous forecast of $2,500,” it said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.