As the monsoon clouds picked up pace, the bearish dark cloud cover over the Indian equity market has been taken out decisively with benchmark indices climbing new highs for the third day.

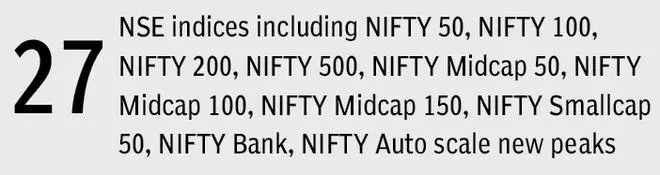

On Friday, the Sensex gained another 803.14 points, or 1.26 per cent, to close at a new high of 64,718.56. The broad-based Nifty was up 216.90 points, or 1.14 per cent, and saw its best closing at 19,189.

- Editorial. Retail investors must stay cautious

Strong FPI inflow

This comes on the back of renewed investment by FPIs taking the overall inflow to over $10 billion in FY24. In June, FPI inflow in the equities market stood at ₹47,148 crore, the highest since August 2022.

Amol Athawale, Technical Analyst, Kotak Securities Ltd, said, “There is a clear picture emerging that India has been showing strong resilience in all the growth parameters and is poised to do well going ahead. With most global economies, including China, witnessing degrowth, India has emerged as a green shot in a bleak scenario, hence investors are reposing strong faith in local stocks.“

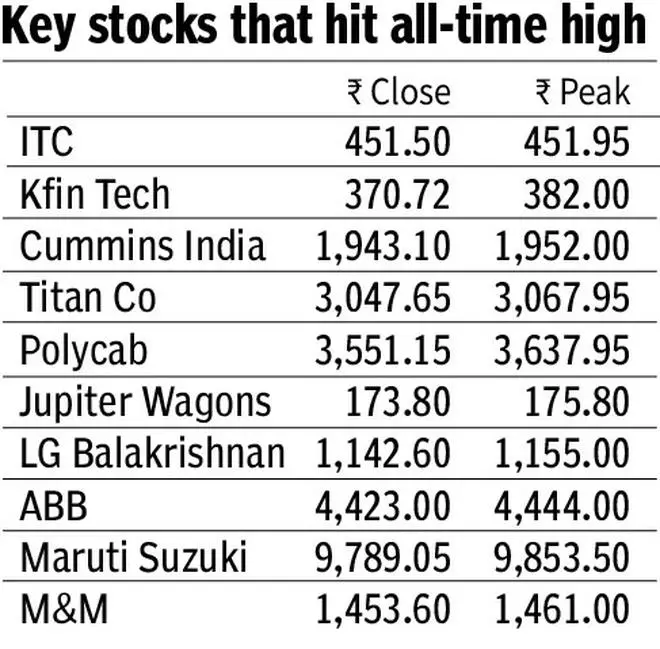

All of the sectoral indices ended in green except Nifty Metal which ended largely flat. Nifty IT (+2.5 per cent), Nifty Auto (+2.1 per cent) and Nifty PSU Bank (+2.1 per cent) were the major gainers. Among the Sensex stocks, M&M was the top performer gaining 4.1 per cent. Infosys jumped 3.2 per cent while IndusInd Bank was up 3 per cent. Sun Pharma gained 2.8 per cent, TCS 2.6 per cent, Maruti 2.5 per cent and L&T 2.2 per cent.

Global cues

Developments in the US also added to the bullish sentiments. US stocks ended mostly positive on Thursday after strong economic data which bolstered expectations that the US Fed will raise interest rates further to tame inflation. A final revision to US first-quarter GDP showed the economy growing at an annualised pace of 2 per cent in the first three months of the year, well above the 1.3 per cent rate previously reported, said Mitul Shah, Head of Research at Reliance Securities.

“With positive surprises assisting buoyancy in the global market and the advance of the southwest monsoon, the domestic market succeeded in marching to new highs with renewed strength. Global investor sentiments were uplifted by a favourable revision in Q1 GDP, a fall in jobless claims and the positive outcome of the Fed’s US bank stress test,” said Vinod Nair, Head of Research at Geojit Financial Services.

Looking forward, markets are likely to sustain momentum as positive monthly auto sales numbers would take centre stage on Monday. “The near-term uptrend of Nifty remains intact and one may expect Nifty to reach up to 19,500 levels in the coming week. Immediate support is at 19,050 levels,” said Nagaraj Shetti, Technical Research Analyst, HDFC Securities.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.