Benchmark indices fell over a per cent on Monday with top corporates reporting flattish growth during the second quarter. The US Presidential election and an interest rate decision from the US Federal Reserve later this week also weighed on sentiment.

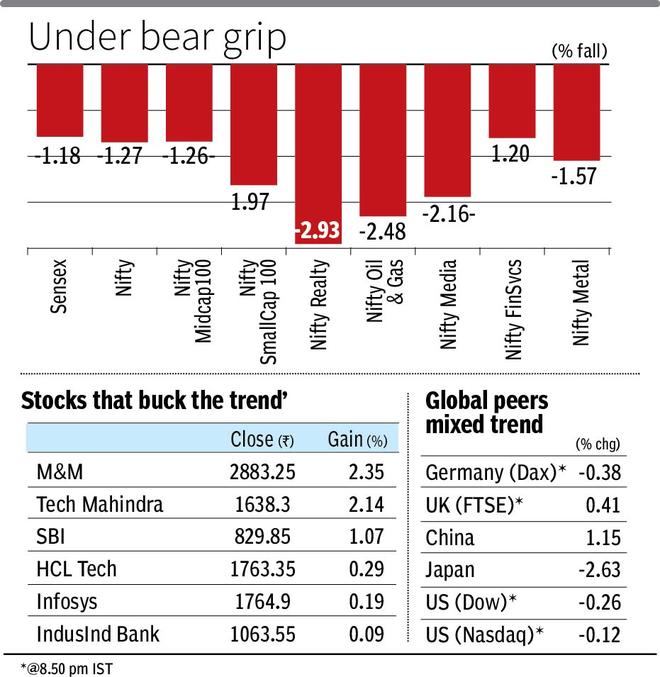

The Sensex declined 1.18 per cent to 78,782, while the Nifty slid 1.27 per cent to 23,995, with both indices posting their steepest single-day losses since October 3. The market downturn comes after a challenging October that saw benchmarks shedding about 6 per cent due to record foreign outflows and lacklustre earnings.

The earnings of 34 Nifty companies that have declared results so far have been flat year-on-year. The earnings growth of 166 companies which announced their Q2 results have declined by 8 per cent YoY, the lowest in 17 quarters, according to a note by Motilal Oswal Financial Services. Auto companies have posted better-than-expected sales in October amid the festival season and discounts offered by original equipment manufacturers.

volatility likely to continue

“We expect markets to remain subdued on the back of several global events, consistent FPI selling and tepid earnings by domestic companies so far. This week will be crucial as lot of index heavyweights will announce results and could lead to stock specific action,” said Siddhartha Khemka, Head - Research, Wealth Management, Motilal Oswal Financial Services.

FPIs sold shares worth ₹4,329 crore on Monday. Realty and Oil & Gas indices slid the most, falling 2.9 per cent and 2.5 per cent, respectively. Other sectors also experienced notable drops, barring Nifty IT which ended flat. India VIX, a fear gauge, surged 5 per cent to reach 16.7 levels.

Vinod Nair, Head of Research, Geojit Financial Services, said: “As expected, India is underperforming its global peers due to excess valuation. The ongoing sell-off has deepened by weak Q2 earnings, dampening investor sentiment. Continued volatility is anticipated in the short-term, as attention shifts to the closely contested US presidential election. Additionally, key economic events such as the US Fed and BoE policy decisions, will be critical in shaping market movements.”

The Fed is expected to cut interest rate by 25 bps, after a 50 bps cut in September. Most Asian markets traded positive on Monday, with South Korea’s Kospi and China’s Shanghai Composite ending with gains of over a per cent. European indices CAC and DAX were trading marginally in the red, while FTSE was in the green. US indices opened in the red.

The next crucial support for the Nifty is at around 23,500, which is the 200 day exponential moving average. Any bounce back from here could find strong resistance at 24,200 levels.

“The sharp downside breakouts after minor pullback rallies of the last few weeks signal a downside breakout of the bearish flag patterns. This could mean that the market is currently in a strong downside momentum,” said Nagaraj Shetti, Senior Technical Research Analyst, HDFC Securities.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.