Just ahead of the crucial meeting of the US Federal Reserve, foreign portfolio investors (FPIs) turned net buyers in Indian markets during the first week of November. This is after being continuous sellers for the previous two months. In November so far, the FPIs have infused ₹15,280 crore in Indian equities on hopes that the Fed may go soft on its rate hike and extremely bearish commentary.

“Going forward, Foreign Portfolio Investors (FPIs) flows are expected to remain volatile in the near term given the headwinds in terms of monetary tightening, geo-political concerns among others,” Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities, said.

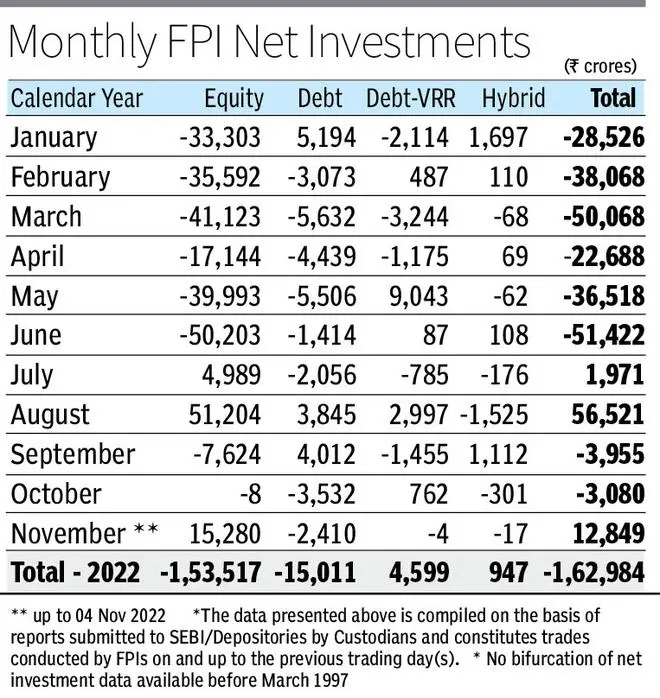

According to the data with depositories, FPIs invested ₹15,280 crore in equities during November 1-4. This came following a net outflow of just ₹8 crore last month and ₹7,624 crore in September.

Earlier, it was in August that FPIs were huge buyers in Indian stocks to the tune of ₹51,200 crore. In July, they bought stocks worth nearly ₹5,000 crore. Before that, foreign investors were net sellers in Indian equities for nine months in a row which started in October last year. FPIs were sellers in October initially but the sell-off had slowed dramatically as the US markets started rallying on the back of extreme negative sentiment.

So far this year, the total outflow by FPIs in equities has reached ₹1.53 lakh crore.

Related Stories

Index Outlook: Sensex, Nifty 50 gear up for a fresh rally

The benchmark indices have the potential to make new highsIn the current month, foreign investors made an investment in hopes that the aggressive rate hike cycle is nearing its end. “Some of the macro-economic data in the US turned out to be better than expected, thereby indicating a lower probability of any immediate adverse impact on the US economy,” Himanshu Srivastava, Associate Director - Manager Research, Morningstar India, said.

Last week, the US Fed hiked the interest rates by another 75 basis points and followed up with extreme bearish commentary. However, a day after the rate hike was announced, there were other members in the US Fed who told the news media that they expected the pace to slow if inflation remained lower, following which US stock markets again rallied on Friday. FPIs have now gone net long in the index futures segment compared to the near-record short positions they held a couple of months ago, data experts said.

"The strong FPI flows in Indian markets in the first week of November was on the back of expectations that the US Fed in its FOMC (Federal Open Market Committee) meeting announcement on the 2nd of November would turn more dovish than they had been in the past post another 75 bps rate hike. This has led to a risk on the environment globally thus leading to increased FPI flows to India," Manish Jeloka, Co-head of Products & Solutions, Sanctum Wealth, said.

Further, FPI flows in India will depend on global crude oil prices, US bond yields, and the dollar index, experts said.

“The fact that FPIs are buying in India even when the US bond yields and dollar are rising, is important. This is the reflection of FPIs’ confidence in the Indian economy, particularly when the global economy is slowing down,” V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said.

“Amongst global recessionary conditions, India is slightly better placed due to its domestic demand for consumption. The Diwali festive season also added some cheer. The RBI is continuously monitoring inflation, robust GST collections and improvement in the recent PMI data may have led to the positivity in FPI inflows,” Anita Gandhi, whole-time director and Head Institutional Business, Arihant Capital, said.

Related Stories

Global 360: Will the dollar continue to struggle?

Crucial support is at 109 which must hold to avoid a steeper fallShe said that the ongoing result season, oil and dollar movements, are factors to be closely watched.

"A major likely trend, going forward, is capital moving away from China which is plagued by serious economic issues and some political concerns. Among emerging economies India is best placed to attract the capital moving away from China. Therefore, FPIs' buying trend is likely to continue," Vijayakumar said.

On the other hand, foreign investors have pulled out ₹2,410 crore from the debt market during the period under review.

Apart from India, FPI flows were positive for South Korea, Thailand and Philippines so far this month.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.