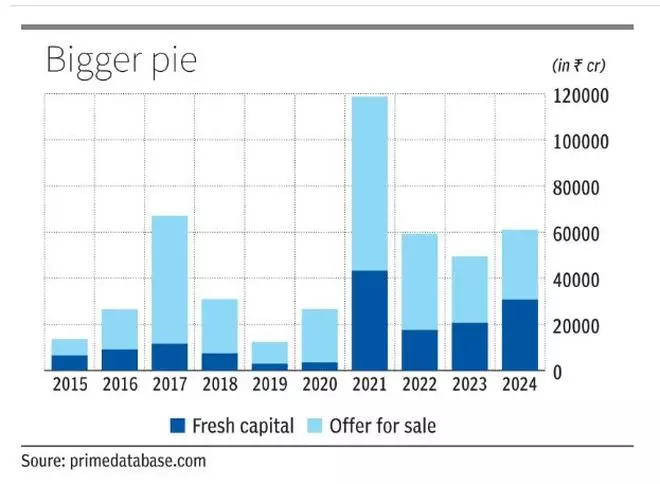

Fresh capital raised through initial public offerings (IPOs) has exceeded the amount raised through offer for sale (OFS) this year, for the first time in 12 years.

A sizeable quantum of fresh capital has been raised by Ola Electric Mobility (₹5,500 crore), Bajaj Housing Finance (₹3,560 crore) and Brainbees Solutions (₹1,666 crore) in CY24. Major companies that opted solely for a fresh capital raise include Juniper Hotels (₹1,800 crore), Jyoti CNC Automation (₹1,000 crore) and Bansal Wire Industries (₹745 crore).

The past few years had seen the dominance of companies tapping the market to provide an exit to promoters and private equity players through an OFS. Since CY13, the amount raised in IPOs through an OFS has always been higher than that through fresh capital raise. Barring CY10, the reverse was true for earlier years.

The economic slowdown may also have dissuaded companies from embarking on capital-intensive projects, minimising the need for fresh fundraise in the past few years, said experts.

Back to market

“A lot of private equity-led companies that were seeking exits have already come to the market and listed in the past few years. Companies that are coming to the market now are either seeking growth capital or have PE players that are not seeking an immediate exit. A part of the reason for this could be that the PE players are now meeting their capital needs by way of exits through secondary block sales from listed companies,” said Munish Aggarwal, Head - Equity Capital Markets, Equirus.

Companies had raised ₹43,329 crore by way of fresh capital in CY21, the most in absolute terms. This was largely due to a string of sizeable fresh fundraise by new-age companies such as Zomato (fresh issue of ₹9,000 crore), Paytm (₹8,300 crore) and PB Fintech (₹3,750 crore).

A similar story may play out this year as well – after Ola and Brainbee’s ₹7,166 crore fresh fundraise, electric two-wheeler maker Ather Energy has filed its draft papers to raise ₹3,100 crore in fresh capital. Aggarwal believes that the gap between fresh fundraise and OFS will only increase this year.

Historically, the bulk of the fresh capital raised has been utilised towards expansion and building new plant and machinery, followed by retirement of debt, meeting working capital needs and general corporate purposes.

“A higher amount of fresh capital being raised is not necessarily a positive just as a higher amount of offer for sale is not necessarily a negative. Ultimately, investors should evaluate the quality of the company and the valuation at which it is being offered,” said Pranav Haldea, Managing Director, PRIME Database.

Risk capital

Back in the 90s and 2000s, most companies that hit the market with IPOs were greenfield in nature and primarily raised fresh capital. Given their early stage, several of them shut shop or vanished with investor money. The same risk capital which companies earlier raised via IPOs is now being provided by private equity and venture capital investors.

This has meant that companies that have tapped the market in the past few years have been more advanced in their life cycle and have attained a certain scale, said experts.

“These investors would have invested 5-6 years ago and it is important that they get an exit so that they can return money to their investors and thus get capital to invest in the next set of companies,” said Haldea.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.