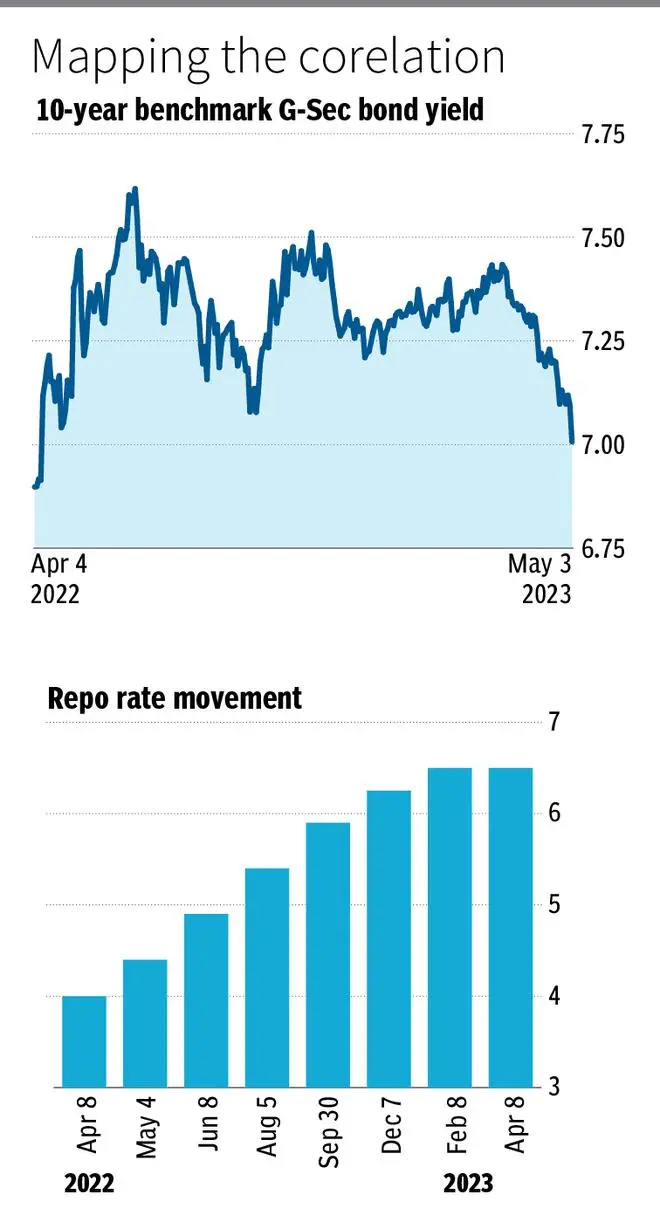

Government Securities (G Secs) rallied on Wednesday with the yields closing at the lowest level in 13-months, in sync with the movement in US Treasury yields which fell on expectations that the Federal Reserve’s rate hike cycle may end soon.

Yield of the widely traded 7.26 per cent 2033 G Sec ended the day at 7.0057 per cent (previous close: 7.0942 per cent), marking a 9 basis point slump.

The closing price of this security was ₹101.76 (₹101.1375). The next widely traded security, the 7.26 per cent 2032 G Sec, ended the day at 7.0566 per cent, down 8 bps (previous close: 7.1401 per cent). The closing price of this security was ₹101.355 (₹100.79).

- Also read: Auction: State Govts’ borrowing costs soften

Eyes on Fed

“The trigger for Wednesday’s G Sec rally was the likelihood that the Fed will hit the pause button and the thaw in global crude oil prices, which were at a five-month low. Lower oil prices could bring down inflation. The RBI’s monetary policy committee has already maintained status quo on the policy rate,” said a trader with a public sector bank.

Since April 6, when the monetary policy committee unanimously voted to keep the policy repo rate unchanged at 6.50 per cent, yield of the benchmark 10-year G Sec has slumped 27 bps, with its price shooting up ₹1.91.

HDFC and HDFC Bank are understood to have bought G-Secs in a big way on Wednesday in order to comply with statutory liquidity ratio (SLR) requirements in view of their impending merger. Banks are required to maintain SLR at 18 per cent of their deposits. Insurance companies, too, piled in, buoying the G Sec market.

- Also read: RBI to allow lending and borrowing of G-Secs

‘Not sustainable’

Marzban Irani, CIO-Fixed Income, LIC Mutual Fund, said the market was buoyed by the possibility that the Fed may end its tightening cycle.

“However, this rally is not sustainable. If the Fed hikes the rate and indicates that it may pause going ahead, the yield of the 10-year benchmark could dip to 6.95 per cent and trade in the 7.00-7.25 per cent band, going ahead,” he said.

Experts say the dip in G Sec yields could help both the government and the India Inc to reduce their cost of borrowings.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.