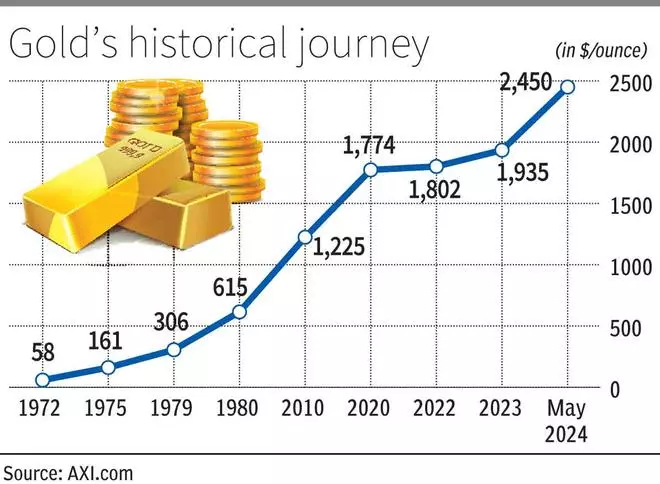

After declining about 5 per cent since soaring to a new high of $2,450 a troy ounce (oz) last month, gold prices will likely come under pressure this quarter. China pausing its gold purchases, the US labour market looking strong and indications of global interest rates remaining high will drag the yellow metal, say analysts.

“We expect gold prices to come down slightly from their current levels this quarter as the Fed continues its cautious approach, and with geopolitics already being factored into the current price,” said Ewa Manthey, Commodities strategist, ING Think.

Price forecast

ING Think, the financial and economic analysis wing of Dutch multinational financial services firm ING, said it sees prices averaging $2,300/oz in the second quarter and an annual average of $2,255 in 2024.

“We see prices peaking in the fourth quarter, averaging $2,350/oz on the assumption that the Fed starts cutting rates in the second half of the year and the dollar and yields weaken,” said Manthey.

Zurich-based private banking corporation Julius Baer’s research team said while chasing gold has been one of the favourite pastimes of global investors year to date, “from a pure price perspective, we still see more downside than upside in the medium to longer-term”.

Saish Sandeep Sawant Dessai, analyst, Angel One, said gold prices dropped nearly 3 per cent last week, marking their third consecutive weekly decline. The fall was triggered by a stronger-than-expected US jobs report, which dampened hopes for interest rate cuts this year.

Quite operation

On Tuesday, gold was quoted lower at $2,305.90/oz. In India, the yellow metal on the Multi Commodity Exchange (MCX) dropped by ₹160 to ₹71,275 per 10 gm. In Mumbai, the spot price for 24-carat gold (.999 fineness) was ₹7,119 a gm and 22-carat jewellery gold was ₹6,521.

The precious metal’s decline was driven by China halting bullion purchases in May, according to the FXEmpire.com website. “A stronger-than-expected US labour market, suggesting US interest rates may remain high longer-than-anticipated. These factors raise questions about gold’s value without China’s support,” it said.

Gold’s recent rally, lasting for months, was attributed to aggressive central bank buying, mainly China. The stalling of the yellow metal’s surge has led to speculation that central banks are still buying, stopping or booking profits.

“Unlike high-profile investors who publicly discuss their trades, central banks operate quietly, leaving markets guessing their next moves. This uncertainty has turned long-term bullish investors into short-term traders, increasing market volatility,” said FXEmpire.

Strong US data

Jateen Trivedi, V-P Research Analyst-Commodity and Currency, LKP Securities, said the possibility of sustained higher interest rates is weighing on gold.

“Strong non-farm payroll data boosted the dollar index to 105, further pressuring gold prices. Additionally, profit booking and concerns over China potentially halting gold purchases are contributing to the current weakness in gold,” he said.

Angel One’s Dessai gold prices will likely to continue their decline. Julis Baer’s research team said from a portfolio perspective, gold remains a hedge against economic and systemic risks in financial markets, such as a further weaponisation of the US dollar.

ING Think’s Manthey said May’s stronger-than-expected US jobs report has pushed back expectations on when the Fed may start cutting rates. “Lower rates typically boost gold, which doesn’t pay interest,” she said.

Fading appetite

ING Think’s economists think the US Fed could push its projections for a rate cutback so that they could end up with two cuts in 2024 and four cuts in 2025 rather than three cuts in 2024 and another three in 2025.

On China, she said China’s appetite for gold started to fade in April, when the People’s Bank of China bought only 60,000 oz, down from 160,000 oz in March, and 390,000 oz in February. Gold’s record-breaking rally might dent demand for now.

Manthey said investor holdings in gold ETFs (exchange-traded funds) generally rise when gold prices gain, and vice-versa. However, holdings have declined for much of 2024, while spot gold prices hit record highs until ETF flows finally turned positive last month.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.