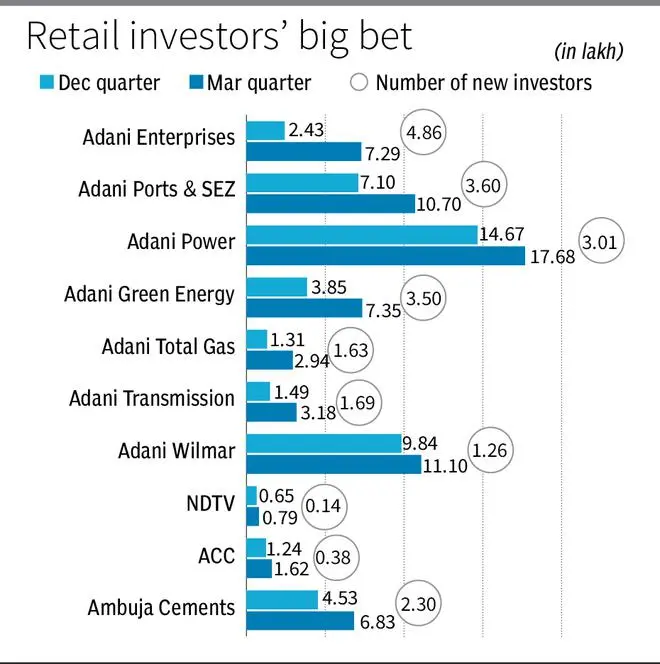

The Hindenburg report on Adani Group might have created a lot of controversy at the political and corporate levels, but it failed to dent the confidence of retail investors. For retail investors, the Hindenburg report is a God sent opportunity, as lakhs of them bought the beaten-down Adani Group stocks during January–March 2023.

On the other hand, institutional investors cold-shouldered the Adani Group stocks. Foreign portfolio investors have reduced their stake, while mutual funds, which had largely ignored the group, have further reduced their holdings. Even promoters have reduced their holdings in some of them since being acquired by GQG Partners.

Flagship Adani Enterprises was the star attraction for retail investors, as over 4.86 lakh of them entered the stock in the January-March quarter. The stock, after the short-seller Hindenburg’s report came out on January 28, crashed to a low of ₹1,017.10 from around ₹3,440 level. Adani Enterprises had hit an all-time high of ₹4,190 on December 12, 2022.

According to Arun Kejriwal, founder of Kejriwal Research & Investment Services Pvt Ltd, most of them are “brand new” investors.

“When the share price of Adani Enterprises fell from a high of ₹3,100 to ₹1,100, most of them felt the price was attractive. Those who thought they missed the bus earlier accumulated at the lower level,” he said. If one compares the retail shareholder base with the respect to market-cap of Adani Enterprises, it is the lowest among the other group companies.

That is why Adani Enterprises saw the highest influx of retail investors, he explained.

Thanks to new investors, their holdings in the majority of group companies doubled in percentage terms. From 1.86 per cent, retail investors’ stake rose to 3.41 per cent in Adani Enterprises. In Adani Ports, it went up to 4.1 per cent (2.86 per cent). A similar pattern was witnessed in other group companies.

The recently-acquired companies ACC, Ambuja Cement, and NDTV too saw fresh entrants from retail investors, albeit in small numbers when compared with “Adani-tag” companies.

Thumbs up from LIC

The Life Insurance Corporation of India remained invested in most Adani Group stocks. In Adani Enterprises, the major insurance company’s holdings rose to 4.28 per cent from 4.25 per cent, of which LIC now holds 4.26 per cent (up from 4.23 per cent). However, in Ambuja Cements, LIC’s holding slipped marginally to 6.30 per cent from 6.33 per cent and in Adani Ports to 9.12 per cent (9.14 per cent).

Adani Total Gas, Adani Green Energy, and Adani Transmission saw a marginal hike in LIC holdings.

According to a stock dealer in Chennai, the group announcing its shareholding pattern within a few days of the quarter ending is a sign of good corporate governance. However, it remains to be seen whether retail investors’ faith in Adani Group stocks will pay off. According to him, the majority of Adani Group stocks, as pointed out by valuation guru Ashwath Damodaran, are still not cheap.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.