India-focused offshore funds and ETFs — key investment vehicles through which foreign investors invest in Indian equities — saw combined net inflows of $7.98 billion in the quarter ended September, the highest to date over a quarter, surpassing the previous highest flows of $5.58 billion seen in the first quarter of 2015. The assets of the category rose 18.2 per cent to $59.8 billion in Q2, even as the Sensex rose 1.7 per cent.

India-focused offshore funds saw net inflows of $5.7 billion, while India-focused offshore ETFs received $2.28 billion in Q2 — the highest so far in a quarter for both segments.

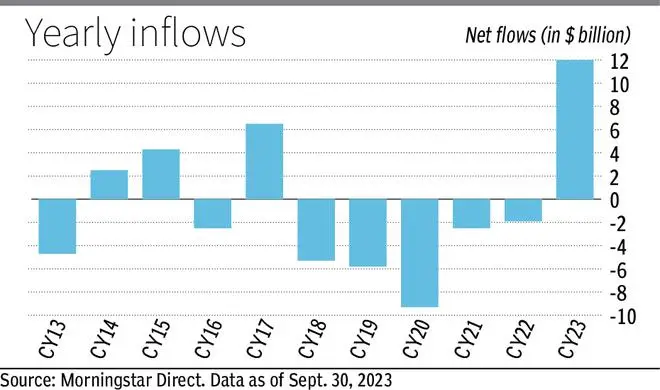

This was the fifth quarterly inflow for the offshore funds after 17 straight quarters of outflows from the quarter ended June 2018. The segment has received $8.4 billion in flows in CY23 so far, compared with outflows of $900 million and $3.5 billion in the previous two years. India-focused offshore ETFs have received $3.53 billion this year, compared with outflows of $952 million in CY22.

- Also Read: Gold ETFs add more glitter this Dhanteras!

“Despite an uncertain global economic environment, the Indian economy and markets have been resilient compared with other economies. Moreover, there is a positive economic growth outlook for India, which has attracted foreign investors with a long-term perspective towards Indian markets,” said Himanshu Srivastava, Associate Director, Morningstar Investment Adviser India.

Most India-focussed offshore funds are actively managed and have expense ratios substantially higher than those of ETFs. Their continuing popularity, despite higher expenses, indicates that many foreign investors prefer active management over passive when it comes to investing in India, said Srivastava.

FPI flows

Meanwhile, FPI flows turned positive in November after two months of outflows, NSDL data shows. FPIs pulled out $4.7 billion from Indian equities in September and October.

The recent inflation data from the US and UK raised hopes for an end to the interest rate cycle, as evidenced by the ease in bond yields. This is likely to draw FPI flows into emerging markets.

BofA Global Research’s Asia Fund Manager Survey for November sees investors profess a likening towards India (net 25 per cent overweight) and Indonesia (net 13 per cent overweight) apart from Japan, while Thailand (net 13 per cent underweight), China, and Australia (each net 9 per cent underweight) remain unloved. Its global fund manager survey, however, re-iterates a gloomy outlook for the world, as a net 57 per cent of participants brace for a weaker economy in the next 12 months.

Morgan Stanley has set a base case target of 74,000 for the benchmark Sensex for December next year, implying a 14 per cent upside potential from current levels. The target assumes continuity in government with a majority mandate, robust domestic growth, no protracted recession for the US, and benign oil prices.

This level suggests that the BSE Sensex will trade at a trailing P/E multiple of 24.7x, ahead of the 25-year average of 20x. The premium over the historical average reflects greater confidence in the medium-term growth cycle in India.

The brokerage expects earnings to be strong for FY24 and FY25, with an improvement in margins led by a durable rise in capital spending and benign material prices. The bear case for earnings is a big slowdown in global growth, rising commodity prices, and an election outcome that significantly alters corporate investment sentiment.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.