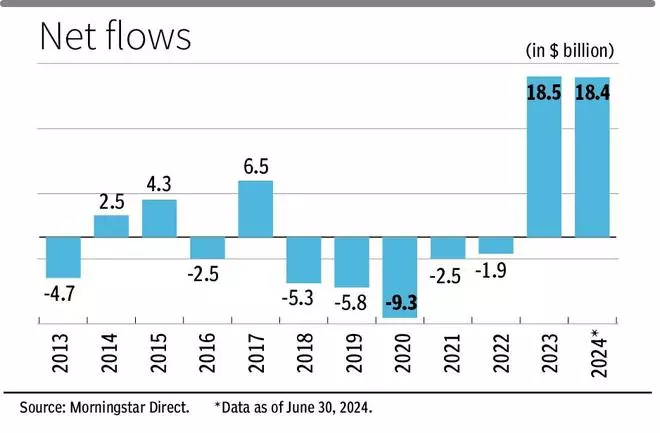

The net inflows into India-focused offshore funds and ETFs increased to $9.4 billion in June quarter against $9 billion in March quarter. It is the eight consecutive quarter of inflows into these overseas funds since the quarter ended September 2022, according to Morningstar report.

Within this category, the India-focused offshore fund segment witnessed net inflows of $10.6 billion this year till June. On the other hand, India-focused offshore ETFs received net inflows of $7.8 billion during the same time-frame.

Robust net inflows and a strong rally in the Indian equity markets pushed up the asset base of the India-focused offshore fund and ETF category by 42 per cent to $102.3 billion against $72.2 billion in December, 2023.

Growing confidence

Himanshu Srivastava, Associate Director, Morningstar Investment Research India said the net inflow of $18.4 billion reflects growing confidence among foreign investors in India’s long-term potential. This robust inflow highlights India’s appeal as a stable and promising investment destination, driven by a resilient economy, improving corporate earnings and a strong focus on reforms, he said.

In the six months ended June, the Sensex registered a gain of 9.4 per cent while BSE mid- and small-cap indices surged 25 per cent and 22 per cent.

The India-focused offshore funds and ETF category registered a gain of 14 per cent, whereas MSCI India USD Index delivered a return of 17 per cent over the six-month period as of June.

Out of the universe of 285 funds under consideration, 48 managed to outperform both the category average and the MSCI India USD Index in the first six months of 2024.

The assets of other regionally diversified equity funds and ETFs surged during the first half of the year by 9 per cent to $9.6 trillion against $8.8 trillion in December 2023.

The value of investment into Indian equities in regionally diversified funds also surged to an estimated $369 billion against $313 billion as of December-end, registering an increase of 18 per cent. This is the highest-ever allocation to Indian equities in the portfolios of regionally diversified funds.

Geopolitical tensions, including the ongoing conflicts between Russia and Ukraine, as well as Israel and Hamas, alongside the economic conditions in the US and Europe, will also be critical in determining the direction of these flows, said Srivastava.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.