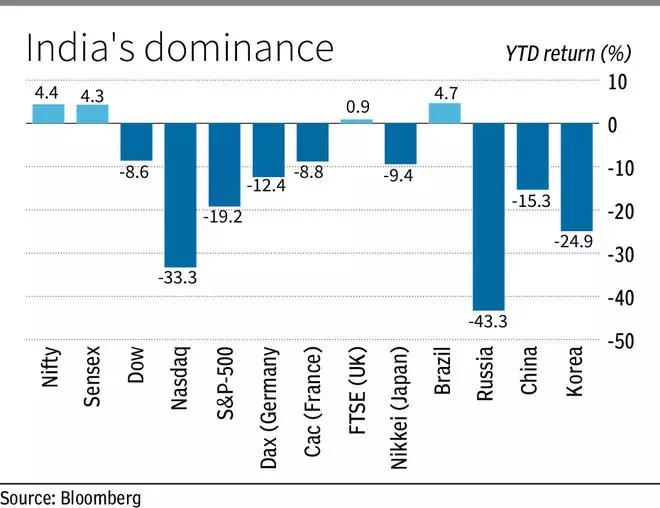

Benchmarks Sensex and Nifty outperformed the world markets in 2022, gaining 5.4 per cent. However, data show that Sensex rallied 25 per cent in six months of the second half of 2022 from its 52-week low levels. Nasdaq and S&P were the worst performing markets this year, mainly as the global tech rally faltered.

This year, Indian mutual funds and insurance companies, piggybacking on the retail inflows, emerged as a counter force to the selling from foreign portfolio investors (FPIs). Nearly $30 billion or ₹2.4-lakh crore worth of FPI selling was absorbed by the retail public in India in 2022, resulting in the outperformance.

Key risks

Like in 2022, most of 2023 will be mainly dominated by fears of aggressive interest rate hikes by the US Federal Reserve and the balancing act by the Reserve Bank of India (RBI), analysts said. There is a view that markets could first fall when the Fed announces the much awaited pivot and stops hiking rates. The rally or the next phase of the bull run would start some time later during 2023 when the Fed signals the beginning of interest rates cuts.

Fears of inflation, rise in oil and gas prices and more populist policies of the Modi government to woo the bottom of the pyramid would continue to weigh down on the markets.

However, the likelihood of political stability in India even after 2024 elections, as the Modi government is the favourite to win the next general elections too, will keep Indian market an outperformer, analysts said.

Budget hopes

February 2023 would be the Modi government’s last full Budget before the elections and hence markets are expecting doles for every segment. There is rumour that the government will hike the holding period for long-term capital gains tax to two or three years from the current one year. This has led to a lot of anxiety in the markets, brokers said.

Goldman Sachs, the largest equity research house in the US, is of the view that India’s stock markets are the most expensive in Asia and emerging markets currently. They say the stock markets here are factoring in the “superior corporate earnings growth” of the next two years in their valuations. However, Goldman believes there is a 12 per cent upside to Nifty from current levels, and the benchmark index would touch 20,500 by the end of 2023.

Research house Morgan Stanley is the most bullish on Indian markets with a 2023 year-end Sensex target of 80,000. According to Morgan Stanley, the Sensex can gain 30 per cent from its current levels if global commodity prices remain low, India is included in the global bond index, and the corporate earnings growth of Sensex companies compound by 25 per cent next year.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.