India’s inclusion in JP Morgan’s emerging market index may boost foreign flows in the debt market, bolster Indian currency, lower cost of borrowing for government, corporates, and banks, as well as help India finance its fiscal and current account deficit, according to market experts and economists

The inclusion may bring in $20–30 billion of passive flows and another $10 billion of active flows from foreign investors into Indian government bonds and comes against the backdrop of steady rupee depreciation against the greenback. India has received $3.5 billion of foreign flows in the debt market this year.

“This attests to the confidence that financial markets have in India’s growth prospects and its macroeconomic and fiscal policies,” said Chief Economic Advisor V Anantha Nageswaran.

Increasing weightage

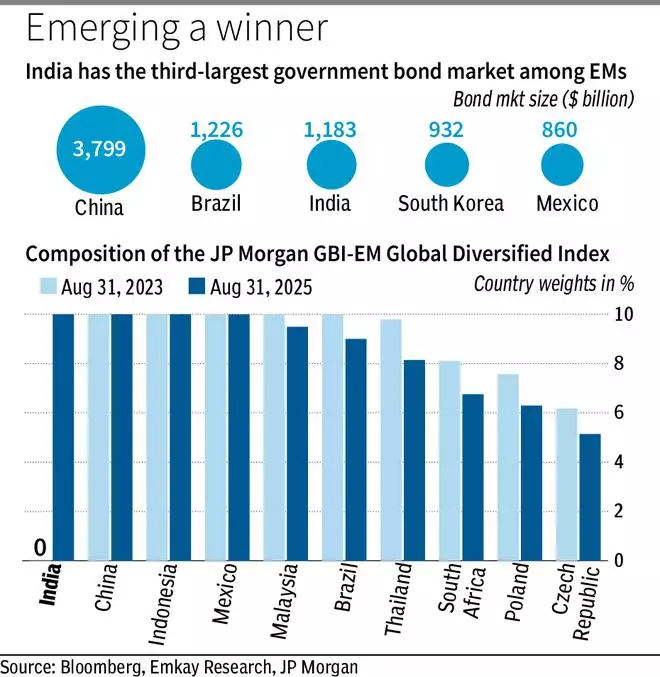

India will be included in JP Morgan’s GBI-EM Global index suite from June 28 next year. India’s weightage is set to increase to a maximum of 10 per cent in the GBI-EM Global Diversified and 8.7 per cent in the GBI-EM Global index.

Currently, 23 Indian government bonds (IGBs) with a combined notional value of $330 billion are index-eligible. GBI-EM GD accounts for $213 billion of the estimated $236 billion benchmarked to the GBI-EM family of indices. Only IGBs designated under the Fully Accessible Route are index-eligible.

India currently has a local currency debt rating of BBB- (Fitch and S&P) and Baa3 (Moody’s).

Demonstration effect

Madhavi Arora, economist at Emkay Global Financial, said: “Structurally, this will lower India’s cost of funding, enhance the liquidity and ownership base of G-secs, and help India finance its fiscal and current account deficit. This does not immediately pave the way for inclusion in FTSE and Bloomberg indexes, which have more stringent conditions. But it could have a demonstration effect in the medium term as the lower risk premia could trigger positive externalities.”

Goldman Sachs reckons India could be considered for inclusion in the Bloomberg Global Aggregate Index, which could bring in another $13-15 billion of additional passive inflows.

According to Suresh Swamy, partner at Price Waterhouse & Co., lower borrowing costs could aid infrastructure projects and foster more efficient trading conditions. However, the inclusion may entail heightened vulnerability to global market fluctuations as India becomes subject to shifts in sentiment, economic conditions, and policies in major economies, influencing bond prices and yields.

Ajay Manglunia, MD & Head, Investment Grade Group, JM Financial, believes that yields in the range of 6.5-7 per cent for 10-year government bonds could become the new normal. Public sector banks raising money through Tier II issuances and infra bonds will benefit, he said.

Investors in long-duration debt funds will benefit as yields come off. Bond prices and yields move inversely.

On Friday, India’s benchmark 10-year bond yield rose 0.4 per cent to 7.164 per cent after dropping to a two-month low in early trade. The rupee fell 0.23 per cent to 82.9 against the dollar after gaining in early trade.

The inclusion of India in global bond indices has been in the works for over 10 years now. In 2013, the country was on the brink of a ratings downgrade, which had prompted the government to think about easing limits in the bond market.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.