The market saw a sharp rally on Friday on positive global cues and a broad-based rally led by large-cap stocks.

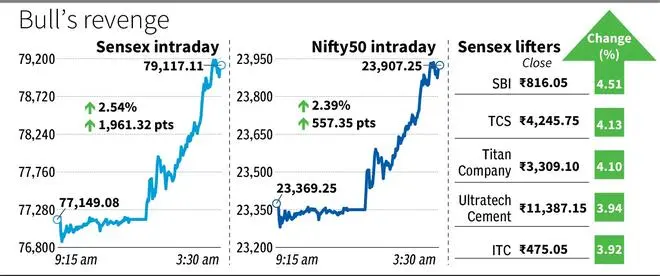

The Sensex surged 1,961 points, or 2.54 per cent, to close at 79,117. The Nifty rose 2.39 per cent to end at 23,907, its best single-day gain in over five months and the best weekly gain (1.59 per cent) in nearly two months.

The rally followed Thursday’s sharp selloff driven by a steep decline in Adani Group stocks after US prosecutors filed charges of alleged bribery and fraud against Chairman Gautam Adani and others.

Sectoral surge

Buying emerged at lower levels in blue-chip stocks on Friday causing several index heavy-weights including RIL to gain significantly, said experts. Favourable US jobs data and appreciation in dollar to support domestic IT stocks. All sectoral indices ended in the green with realty, FMCG, auto, consumption, banks, and IT gaining more than 2 per cent.

FPIs sold shares worth ₹1,278 crore on Friday, provisional data showed.

Vinod Nair, Head of Research, Geojit Financial Services, said: “The market bounced back as investors used the bargain opportunity to accumulate beaten-down stocks. However, investors need more clarity on the trend reversal to conclude that the current bounce-back will turn into a Santa Claus rally. Many of the blue chips are available at below-average valuations, while meaningful corrections in mid- and small-cap indices provide the opportunity for broad-based momentum.”

The corporate earnings scorecard for the second quarter was weak but showed an in-line earnings growth, excluding commodities, according to Motilal Oswal Financial Services. Consumption emerged as a weak spot, while select segments of BFSI are experiencing asset-quality stress. Weak government spending along with excess rainfall also hurt demand.

“As some of the factors self-correct in the second half of FY25, we anticipate a recovery in corporate earnings going forward. In the near term, however, we expect volatility to continue in the market, driven by triggers including State election outcome, FPI activity and global geo-political concerns,” said Siddhartha Khemka, Head - Research, Wealth Management, Motilal Oswal Financial Services.

“Most of the State elections are now over, and the market may find stability as government spending will improve in the coming months to meet the FY25 capex target,” added Nair.

Global Divergence

Global equities were mixed on Friday following gains on Wall Street while geopolitical tensions tempered the atmosphere and lifted oil again. The modest decline in Japan’s October inflation and the 39 trillion yen stimulus package boosted Japan equities. Shanghai Composite was the top loser and slid over 3 per cent. European indices were trading in the green.

The domestic market will now react to the outcome of State assembly elections in Maharashtra and Jharkhand along with other global triggers, including developments in the Russia-Ukraine war.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.