Indian equities rose over a per cent to fresh highs on Friday on robust foreign flows as fears of a sharp slowdown in the US receded somewhat after lower-than-expected jobless claims.

Bank of Japan kept its rates steady on Friday as the central bank adopted a wait-and-watch approach after raising the interest rate in July.

The US Fed had opted for a jumbo 50 bps rate cut on Wednesday, as it shifted its focus to supporting economic growth. The Bank of England stuck to a cautious tone and kept interest rates unchanged, citing inflation pressure.

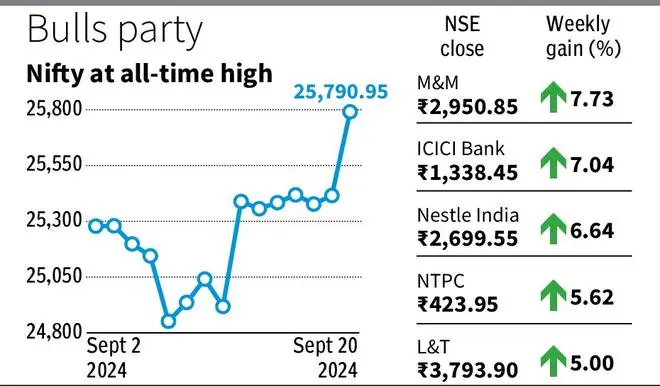

The Sensex rose 1,359 points or 1.63 per cent on Friday to close at 84,544. The Nifty 50 settled at 25,790, up 1.48 per cent. BSE-listed firms’ overall market capitalisation rose to nearly ₹472 lakh crore, enriching investors by about ₹6 lakh crore.

Cash market volumes on the NSE were 43 per cent higher than the previous session aided by FTSE rebalancing volumes. Broad market indices rose less than the Nifty even as the advance decline ratio rose sharply to 2.08:1.

FPIs bought shares worth ₹14,064 crore, provisional data showed.

“We expect the positive momentum to continue backed by strong FPI inflow, healthy domestic macros, and receding concern about the US economy slowing down,” said Siddhartha Khemka, Head - Research, Wealth Management, Motilal Oswal Financial Services.

Barring PSU Bank, all sectors ended in the green. Realty, Metals, FMCG, Private Banks, and Financial Services were top gainers up 1-3%. The IT index remained under pressure mainly due to layoffs and dollar depreciation. Strong monsoon and festive demand boosted the auto index.

“We have seen a sectorial rotation among investors to large caps, especially in consumption, staples, auto, finance, and realty. In the short term, investors are being cautious on export-oriented sectors like pharma and IT due to depreciation in the dollar,” said Vinod Nair, Head of Research, Geojit Financial Services.

Asian stocks traded higher on Friday after Wall Street soared overnight following the Federal Reserve’s outsized rate cut. Hang Seng and Nikkei 225 were the top gainers, up over 1 per cent each. European markets declined on Friday as investors assessed a series of central bank rate decisions made throughout the week and their implications for the global economy.

The short term trend of Nifty is sharply positive, with immediate support at 25650.

“Nifty on the weekly chart formed a reasonable bull candle that has surpassed the congestion area of the last three weeks around 25300-25500 levels and closed higher. There is a possibility of consolidation/breather pattern in the short term, before moving up further,” said Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.