The party in SME IPOs is continuing even as capital markets regulator SEBI has expressed concerns on run-away oversubscriptions, inflated listing prices and subsequent rally in these stocks.

In line with bullish sentiments in the main bourses, about 56 SME companies raised ₹1,633 crore in the first quarter of this fiscal through initial public offering on the SME exchanges. This was much higher than the earlier record of about ₹1,000 crore raised by 34 SME IPOs in the first quarter of last year, as per Prime Database.

Incidentally, SEBI has observed signs of manipulation at both the trading and issuance levels in the SME space. Madhabi Puri Buch, Chairman, SEBI recently said the regulator is working to introduce more disclosures to safeguard investors and use artificial intelligence to improve document examination besides moving towards automated supervision.

Amid raising concerns of froth-building up in SME stocks, the NSE had imposed a price control cap of 90 per cent on pre-open session on listing of SME after the IPO.

Unmindful of SEBI concern, the ₹5.10 crore SME IPOs of Hariom Atta & Spices was oversubscribed 1,963 times. The shares issued at fixed price of ₹48 a share, closed at ₹140 on the day of listing. The share closed at ₹152 on Friday on NSE Emerge. An investment of ₹1.44 lakh for one lot size of 3,000 shares had delivered a profit per lot is ₹2.76 lakh.

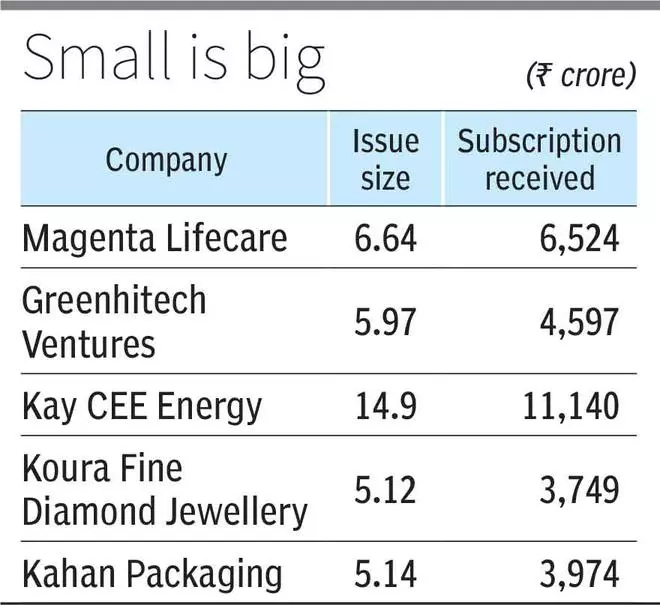

“Most of the SME issues are oversubscribed multiple times due to their offer size. The offer size of Magenta Lifecare was only 2 lakh shares while that of Hariom Atta was 11.55 lakh shares and these shares are sold out in a jiffy given the hype created by merchant bankers,” said Sanjay Shah, a seasoned retail investor.

Tarun Singh, MD, Highbrow Securities said given the kind of valuations and money flow in SME IPO, investors need to be cautious.

The new NSE Emerge listing cap will temper immediate gains and prioritise long-term market health to build sustained investor confidence for robust SME sector, he added.

Listing on the exchange has helped many SMEs with strong business fundamental. For instance, Network People Services Technologies, a banking technology service provider, raised Rs 14 crore by issuing shares at ₹80 a share in August, 2021. The company’s shares closed at ₹2,008 on Friday with a market capitalisation of ₹4,000 crore.

Deepak Chand Thakur, CEO and Co-founder, NPST said the listing on exchange provided much need growth capital for taking the company to next level of growth.

The IPO fund helped to double customer base, strengthen product portfolio and launch a new line of business. The company is now on a strong footing and is regarded among the top UPI and banking players in the country and is gearing to expand operations internationally, he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.