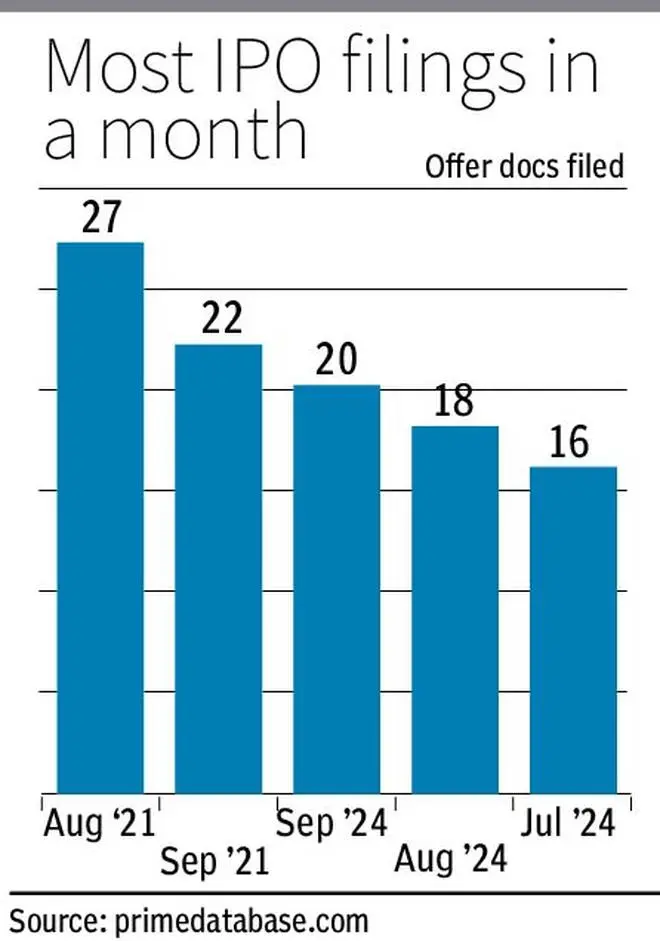

Twenty companies have filed their draft offer documents for initial public offerings (IPOs) in September, the most number of filings in a month this year and the third highest in a decade.

The number of filings this year stood at 106, more than any other calendar year, if the first nine months are considered. The year 2021 had seen 99 filings till September and 126 for the full year, implying that filings this year are on course to breach that number.

Top filings this month include that of NTPC Green Energy, Hexaware Technologies and Schloss Bangalore. Together, these firms may raise over ₹24,000 crore.

The hot streak for IPOs has been primarily driven by domestic liquidity and stable macro-economic factors.

“Companies are making use of the extremely buoyant market conditions and abundant liquidity to launch their IPOs,” said Pranav Haldea, Managing Director, PRIME Database.

Strong response

According to him, response to the IPOs in the past year has been phenomenal, with high subscription numbers and listing pop. This has further encouraged companies waiting on the sidelines to also move forward with their IPO plans.

Sixty two IPOs have hit the market this year, mopping up over ₹64,000 crore, data from primedatabase.com shows. Of this, 12 companies gained more than 50 per cent on listing day over their offer price. Vibhor Steel Tubes and BLS E-services led with returns of 193 per cent and 175 per cent on debut.

Twenty companies are sitting with gains of over 50 per cent based on yesterday’s closing prices, with Jyoti CNC Automation, Exicom Tele-Systems, Platinum Industries, Bharti Hexacom, Unicommerce Esolutions, Premier Energies and Bajaj Housing Finance up over 100 per cent.

Healthy pipeline

There has been a tangible increase in the speed at which IPOs are getting approved and launched, with companies now coming to the market within a week or two of getting the regulatory nod, said experts.

“The pipeline for IPOs remain healthy. You will see a slight slowdown in filings in October after the rush to meet the September deadline. However, it will pick up soon enough,” said Haldea.

Twenty two companies have received SEBI approval for their IPOs and may tap the market to mop up over ₹23,000 crore. Another 53 companies are awaiting regulatory nod and can potentially raise over ₹1.3 lakh crore

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.