Indian financial markets went into a tizzy after the election results showed that Bharatiya Janata Party would have to rely on its partners to form a government, contrary to exit polls that had predicted a comfortable majority.

While the equity market ended in a sea of red, yields of government securities (G-Secs) rose and the rupee declined as investors became jittery over the future of economic reforms in the country.

Reversing the previous day’s gains of over 3 per cent, the Nifty ended at 21,884, down 5.9 per cent, its worst session in over four years. The Sensex tanked 4,389 points or 5.7 per cent to 72,079, after slipping more than 8 per cent intraday. This is the worst election-day showing in at least the last six elections.

Cash market volumes on the NSE rose to a record high of ₹2.71-lakh crore. Broader market indices fell about 8 per cent. The volatility index Nifty VIX hit its highest level in more than two years, reaching 31.71.

Rupee plummets

Yields of the new 10-year benchmark government bonds shot up 10 basis points to 7.04 per cent. The rupee fell the most in over a year, declining 0.47 per cent to close at 83.53 against the dollar.

Investors lost nearly ₹30-lakh crore, with retail and wealthy investors bearing the brunt. Margin calls got triggered even as some brokers faced bouts of technical glitches amid high volumes. As more margin calls get crystallised at the end of the day, another round of selling could follow on Wednesday, said experts.

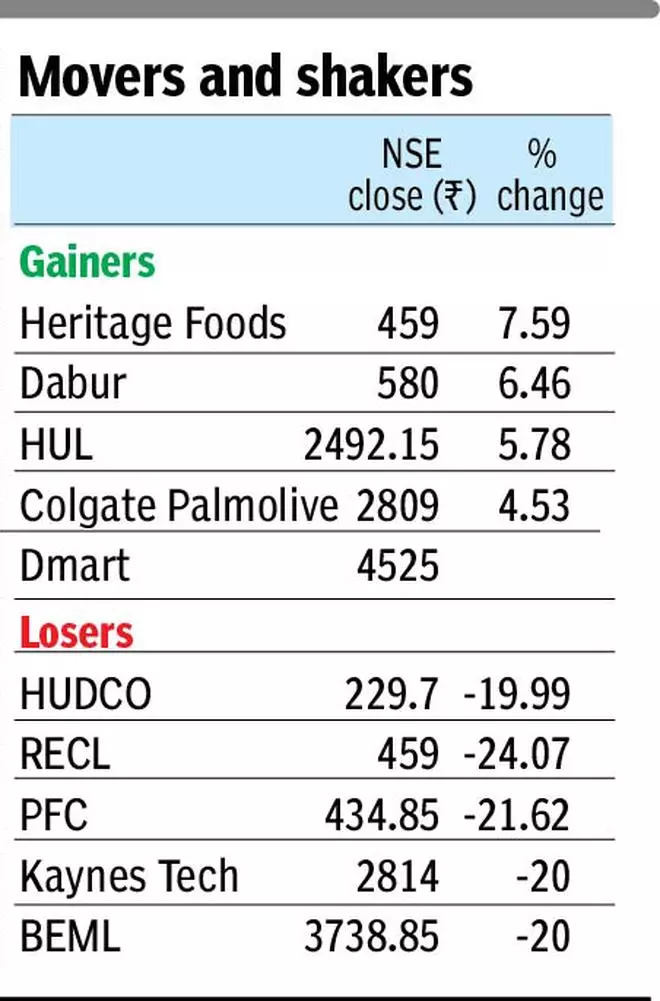

Top losers

Adani Enterprises and Adani Ports were the top Nifty losers, shedding 19.3 per cent and 21.1 per cent, respectively. State lender SBI slid 14.4 per cent. FMCG stocks led by HUL, Nestle and Britannia were the top gainers on hopes that a shift in policy focus will have a positive effect on the rural economy. The Nifty PSE index, representing public sector companies, was down over 16 per cent, with SAIL, BHEL, Power Finance and REC losing over 20 per cent each.

“Investors are concerned about the slowdown in reforms that had been initiated under the BJP-led government. The uncertainty has triggered a correction as investors reassess the outlook under the new political landscape,” said Vinit Sambre, Head - Equities at DSP Mutual Fund.

Gopal Tripathi, Head of Treasury & Capital Markets, Jana Small Finance Bank, said the reduced victory margin may prompt the government to undertake populist measures such as cutting fuel prices and reducing GST, which could have a bearing on fiscal consolidation.

Sambre, however, believes that the development agenda is likely to persist, irrespective of the party that comes to power and the market performance will align more closely with the underlying fundamentals once stability returns.

The RBI policy, the 100-day agenda of the new government, and Budget expectations will provide fresh cues in the coming days.

Asian shares traded mixed on Tuesday, on signs of weakness in the US economy, even as data boosted hopes for an interest rate cut. European stocks slipped, led by a fall in energy stocks as investors refrained from placing huge bets before the European Central Bank’s interest rate decision later this week.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.