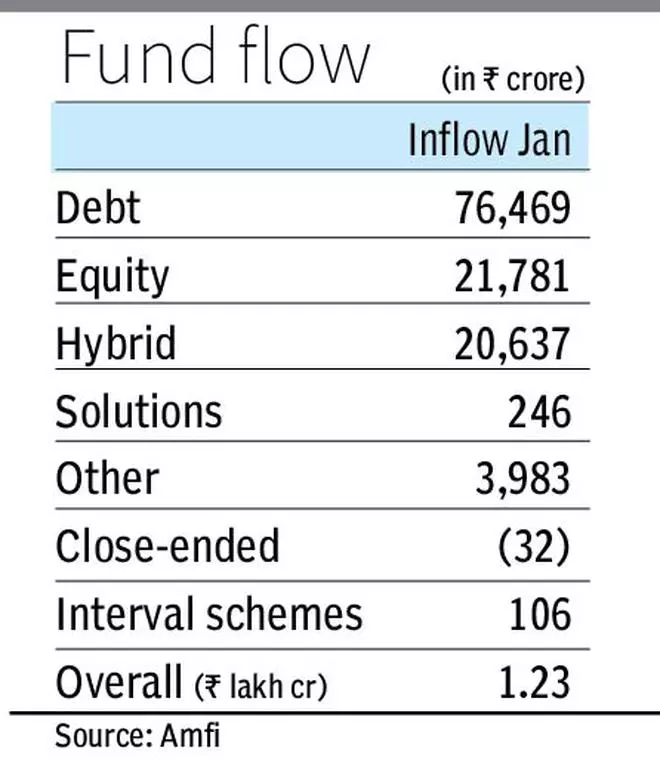

Inflows into equity mutual fund schemes has hit a 21-month high after an increase of 28 per cent last month to ₹21,781 crore against ₹16,997 crore logged in December, largely due to flurry of new fund offers amid a volatile market.

Three NFOs each of equity and hybrid schemes have collected ₹5,214 crore while 11 passive and three debt funds mopped-up ₹1,219 crore and ₹384 crore last month, said the Association of Mutual Funds in India data released on Thursday.

Except for an outflow of ₹202 crore (outflow of ₹491 crore) from focused funds, all the equity schemes have registered an inflow with thematic and small-cap funds receiving ₹4,804 crore (₹6,005 crore) and ₹3,257 crore (₹3,857 crore).

- Also read:The problems small-cap funds face

Multi-cap funds registered an inflow of ₹3,039 crore, while investment in large-caps touched a 19-month high at ₹1,2897 crore (outflow of ₹281 crore).

Via SIP route

Melvyn Santarita, Analyst, Morningstar Investment Research India said while mid- and small-cap funds have the potential to deliver good returns, they are inherently volatile with sharp drawdown risks, opting to invest in this through the SIP route will help ride the volatility.

SIP contribution hit an all-time high of ₹18,838 crore against ₹17,610 crore in December with SIP assets touching ₹10.27 lakh crore (₹9.95 lakh crore).

Venkat Chalasani, Chief Executive, AMFI said the surge in SIP accounts to an unprecedented 7.92 crore last month coupled with 51.84 lakh new SIP registrations, underscores the unwavering commitment of investors towards disciplined wealth creation.

Sustained growth

As the industry navigates through regulatory reforms and embraces the shift towards SIPs, it is evident that mutual fund industry is charting a trajectory of sustained growth, he said.

Hybrid funds registered an inflow of ₹20,637 crore (₹15,009 crore), aided by net investment of ₹10.608 crore (₹10,645 crore) in arbitrage funds and ₹7,080 crore in multi-allocation funds. Debt funds received a net investment of ₹76,469 crore (outflow of ₹75,560 crore).

Overall AUM of the industry increased to ₹52.75 lakh crore against ₹50.78 lakh crore recorded in December with overall inflows rising by ₹1.24 lakh crore.

Anand Vardarajan, Business Head, Tata Asset Management said even while expectations of rate cuts have built in the debt market, investor interests are still seen only in the shorter end. Longer duration funds look attractive from a risk-reward perspective but flows have been tepid, he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.