The portfolio management services (PMS) offered by leading mutual fund houses have delivered better returns than top PMS houses such as Bharat Shah-led ASK Investment Managers, Motilal Oswal PMS and Sourabh Mukherjee-led Marcellus Investment Managers.

Incidentally, these top PMS houses along with Prashant Khemka-driven WhiteOak Capital Management and Hiren Ved-led Alchemy Capital account for over 80 per cent of industry AUM in PMS.

Category-wise performance

In the large-cap category, MF-backed PMS such as ICICI Pru largecap, Aditya Birla Top-200 have delivered 22 per cent and 15 per cent return, while it was 13.5 per cent for Nippon Absolute Freedom over the last three years ended February. In contrast, Ask Select Strategy and Motilal Oswal Value have given 7.8 per cent and 9 per cent return in the same period.

In the multi-cap category, ICICI Contra, Aditya Birla Innovation and Aditya Birla India Special Opportunity have delivered 25 per cent, 19 per cent and 18 per cent over the last three years. Similarly, Invesco Dawn and Aditya Birla CEP has given 17 per cent and 15 per cent.

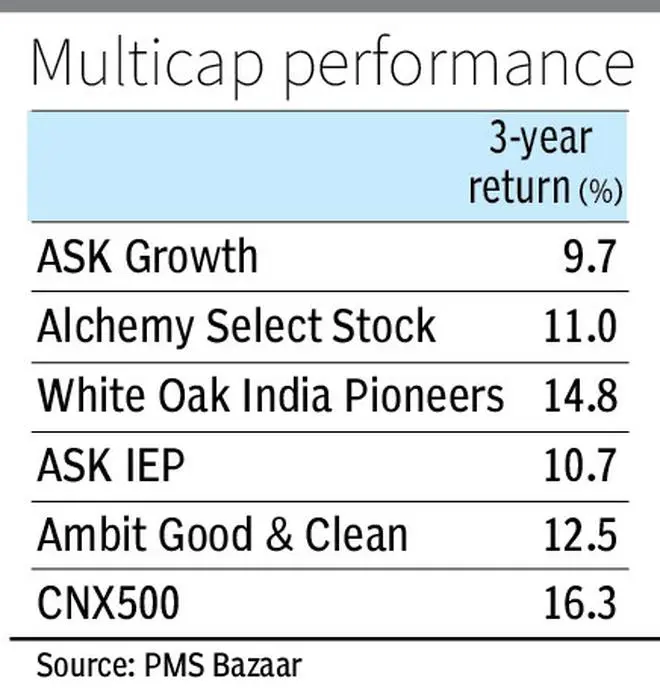

Among leading PMS houses, Alchemy High Growth, ASK Multi-cap India Select and Marcellus Consistent Compounders have given 5.5 per cent, 7.8 per cent and 9.4 per cent return. In fact, most of the top PMS houses have delivered lower the benchmark CNX 500 index return of 16.3 per cent.

In the small- and mid-cap category, Invesco Catepillar and Aditya Birla Select Sector Portfolio have given a return of 24 per cent and 22 per cent, while Motilal Oswal India Opportunity Portfolio and Motilal Oswal India Opportunity Portfolio v2 have given 2.5 per cent and 13.5 per cent much lower than the benchmark Nifty Mid-cap return of 21.5 per cent.

Mahesh Shukla, CEO and Founder, Payme, said mutual fund-backed PMS have delivered better returns in recent days as they have experienced and knowledgeable fund managers who have access to in-depth research and analysis.

Volatility concerns

Considering the volatility in the global markets and the domestic growth challenges, investors need to stick to their asset allocations and invest according to their risk tolerance levels, he added.

The asset under management of PMS has jumped 14 per cent to ₹22.4-lakh crore as of December 2022. PMS is suitable for high networth investors with overall financial portfolio of at least ₹2-2.5 crore.

Leading PMS houses are known for taking aggressive bets on cyclical sectors to deliver better returns for HNIs, but after the recent market fall, these investments have not delivered commensurate return, said a CEO of mutual fund house.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.