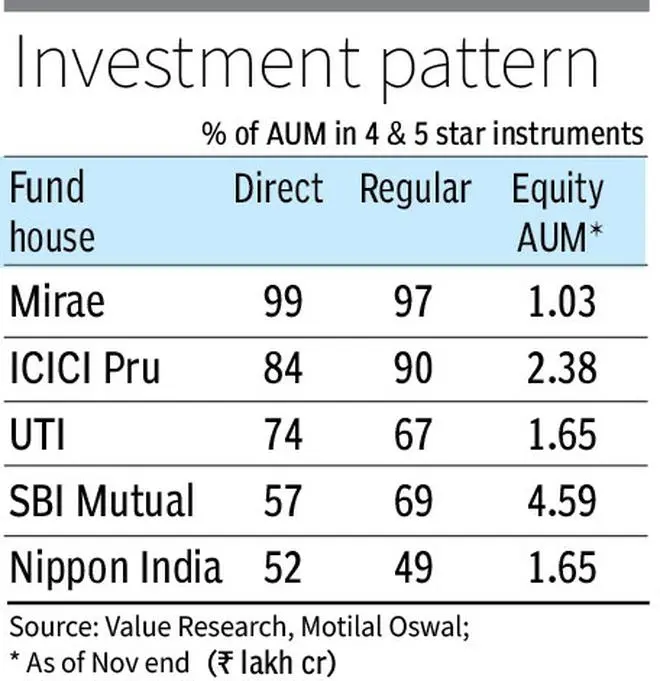

Mirae Asset and ICICI Prudential Mutual Fund have the highest four- and five-star rated assets in the equity and hybrid category, which has been attracting largest inflows in recent months.

As per data from mutual fund tracker, Value Research, Mirae Asset and ICICI Prudential MF have 97 per cent and 90 per cent in terms of top-rated fund asset under management (AUM) in regular plan category.

They are followed by SBI MF and UTI MF with 69 per cent and 67 per cent of their equity and hybrid assets in the highly rated category. Kotak MF and Axis MF have 50 and 49 per cent equity assets with five- and four-star rating.

Fund ratings

Value Research Fund Ratings are based on risk adjusted return. In equity and hybrid funds, the fund ratings for three and five years are combined to give a single assessment of each fund’s risk rating against other funds in each fund category. It does not rate an equity or hybrid fund with less than three years of track record.

In the five-star category, Mirae Asset leads with 36 per cent of equity and hybrid assets, followed by 18 per cent and 12 per cent of Axis MF and ICICI MF. When it comes to four-star, ICICI MF tops with 78 per cent of assets followed by UTI MF, Mirae Asset and SBI MF at 67 per cent, 62 per cent and 60 per cent.

The AUM of the equity and hybrid schemes at ₹20.52-lakh crore account for more than half of ₹40.37-lakh crore of overall asset of the mutual fund industry.

The size of the funds managed by individual mutual funds under equity and hybrid schemes also matters when it comes to taking decision based on rating as any one scheme lagging behind can drag the overall rating of a fund house, said Siddharth Pai, an individual mutual fund distributor.

Investor interest

With the growing direct investment in mutual funds, he said investors should consider individual scheme’s rating to gauge its performance, though previous performance is not a guarantee for future returns.

SBI MF has the highest equity asset of ₹4,58,600 crore as of November-end, followed distantly by ICICI MF and HDFC MF at ₹2,38,600 crore and ₹2,11,900 crore, as per the Motilal Oswal’s Fund Folio report. Nippon India and UTI MF have equity AUM of ₹1,65,300 crore and ₹1,65,100 crore.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.