The MSCI rejig adjustments on Friday led to $2-$2.5 billion in FPI passive flows.

With 13 inclusions and 3 exclusions, the net stock count post-rejig is 146 for India in the MSCI Standard/EM Index. Additionally, there will be a net inclusion of 14 stocks in the Smallcap Index, bringing India’s total stock count in the small-cap index to 497.

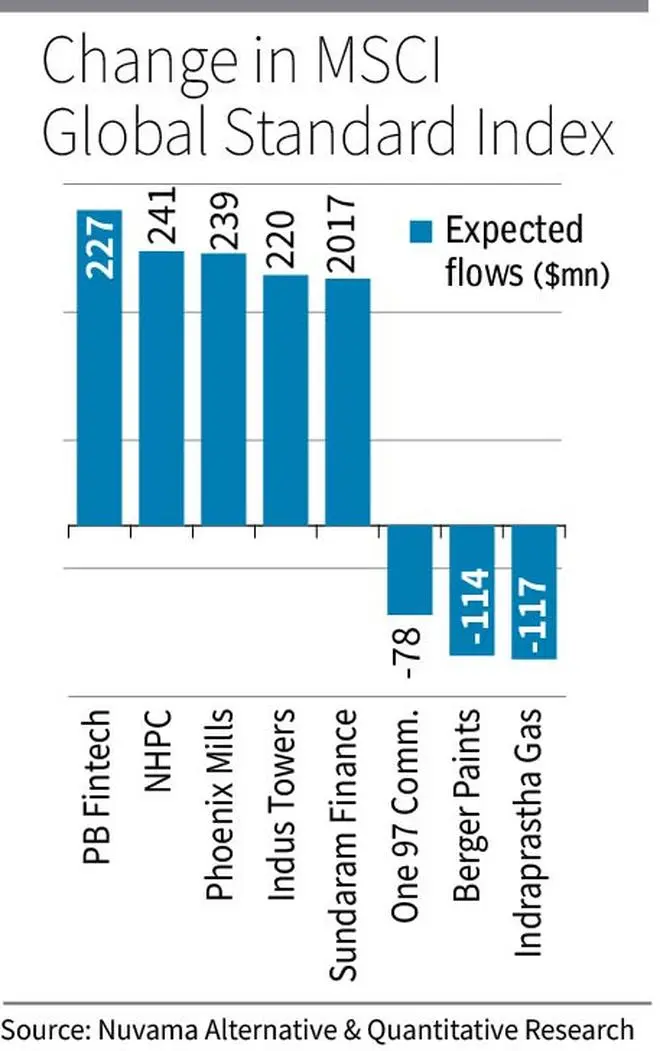

The 13 stocks included in the MSCI Global Standard Index include PB Fintech, Torrent Power, Phoenix Mills, NHPC, Indus Towers, Sundaram Finance, Solar Industries India, Jindal Stainless, Thermax, Bosch, JSW Energy, Mankind Pharma and Canara Bank.

Paytm parent One97 Communications has been excluded along with Berger Paints and Indraprastha Gas. Stocks like Zomato, AU Small Finance and Vedanta are seeing an increase in weightage.

India’s weightage

India’s representation in the MSCI EM Index is set to increase from the current 18.3 per cent to nearly 19 per cent. This increase in weight, in terms of basis points, is the highest among any EM Index in this rejig. The highest representation in the MSCI EM Index is China, with a weight of 25.7 per cent and 703 members in the index.

- Also read: MSCI adds 9 Indian stocks, no exits

India’s weightage in the MSCI EM Index stood at 13 per cent in the beginning of last year, behind Taiwan (14.4 per cent) and China (33.5 per cent). The weightage had remained steady at around 8 per cent from 2015 to October 2020, implying that it has more than doubled in the last three-and-a-half years.

“I remain extremely bullish on India, especially with active participation from mutual funds and HNI/retailers in the Indian equity markets. We should anticipate many more inclusions in the EM index. We are just beginning to scratch the surface of our potential. There is enormous potential for far more additions to happen for India,” said Abhilash Pagaria, Nuvama Alternative & Quantitative Research.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.