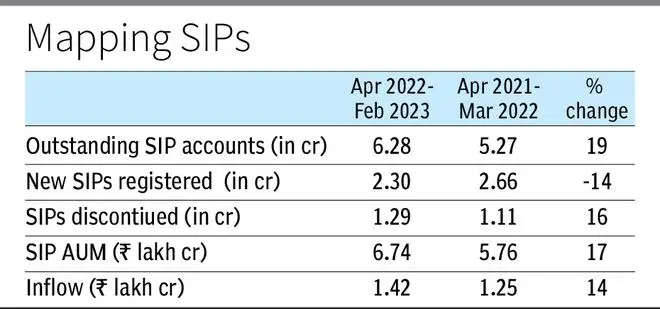

The number of discontinued systematic investment plans (SIPs) has been growing at a faster pace even as new SIPs opened in the first 11 months of this fiscal dipped compared with the whole of last fiscal.

Despite the sharp increase in inflows, the number of SIP accounts discontinued or matured increased 16 per cent to 1.29 crore in the 11 months of this fiscal as against 1.11 crore logged in FY22, according to data by the Association of Mutual Funds in India (AMFI).

On the contrary, new SIPs registered in the last 11 months dipped 14 per cent to 2.30 crore as against 2.66 crore registered in FY22. In March, even if the mutual funds add 24 lakh new SIP accounts, the highest-ever in this fiscal, it will end FY23 at 2.54 crore fresh accounts, which will be about 5 per cent lower than FY22.

Pause button

Kalpesh Seth, Director, Smart Investment Advisor, said investors preferred to stay on the sidelines for the most part of this fiscal as the noise around equity markets turning overvalued got louder and investors hit the ‘pause’ button introduced by mutual funds recently.

Moreover, he added, some SIP accounts which had matured was not renewed, but the good thing is that investors have not redeemed their investments. Attempts to open new SIP accounts have become difficult due to flattish equity returns, said Seth.

The total number of live SIP accounts grew 18 per cent to 6.29 crore in last 11 months compared with 5.28 crore in FY22. The growth is much lower compared to the 42 per cent logged in last fiscal.

Tepid performance

The slowdown in fresh SIP registration can be partly attributed to the tepid performance of mutual funds. The assets under management of SIPs were up only 17 per cent to ₹6.74-lakh crore as of February-end compared with ₹5.76-lakh crore logged in FY22.

The AUM growth in FY22 compared with FY21 was much higher at 35 per cent. The inflows from top 30 cities, too, dipped marginally to ₹8,568 crore in February as against ₹8,646 crore in January while that of beyond top 30 cities slipped 2 per cent to ₹5,118 crore (₹5,211 crore).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.