A strong dollar, elevated US bond yields, and high global crude oil prices may weigh on the sentiment of overseas investors in the near term.

The long-short Nifty index ratio for foreign portfolio investors (FPIs) has dipped to 30 per cent as of Thursday after climbing to 70 per cent levels a few weeks earlier, indicating a build-up of bearish bets by the investors and the probability of sustained selling in the weeks ahead.

On the day of monthly expiry, FPIs had 44,912 contracts of index futures on the long side and 1,02,191 contracts on the short side, data showed.

“The falling ratio clearly indicates that FPIs are carrying shorts and reducing their long positions on global concerns,” said Chandan Taparia, Derivatives and Technical Analyst at Motilal Oswal Financial Services.

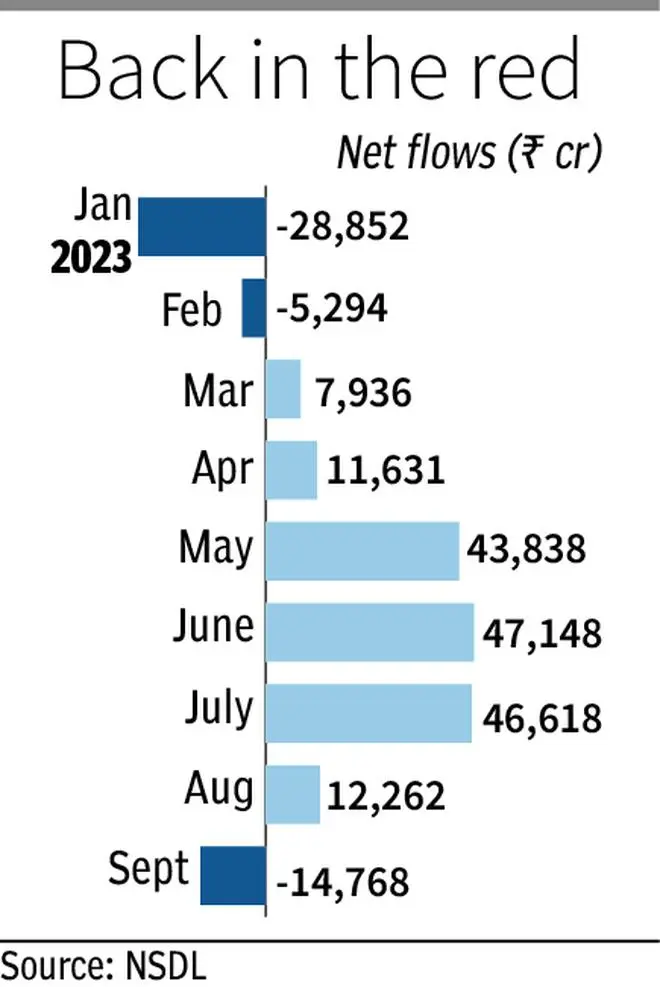

FPIs have net-sold equities worth ₹14,768 crore this month, after six months of sustained buying. Investors also sold ₹2.1 lakh crore worth of index options, the highest in at least two years in the segment, according to data from StockEdge.

“The indices had run up quite a bit and were in an overbought zone. So investors would be tempted to take money off the table in the short term,” said Andrew Holland, the chief executive officer of Avendus Capital Public Markets Alternate Strategies. “The Fed’s higher for longer stance along with signs of China’s recovery has weighed on sentiment, too.”

With oil prices on the boil, Holland believes that the RBI could hold rates for longer as well. On the domestic side, the market will turn its attention to Q2 results and look at commentary emerging from IT firms and banks for further cues, he added.

Brent crude was trading at $93.8 per barrel on Friday, up 0.8 per cent. Analysts at BofA Global Research expect the gauge to average $96 per barrel in the fourth quarter of this year. The dollar index is trading above 105 levels and is up 1.45 per cent in the last month. The US 10-year bond yields continue to hover at around 4.5 per cent and at 16-year highs.

The sentiment still remains positive over the long term. Nomura recently upgraded India to overweight, citing benefits accruing from the “China+1” theme and a large, liquid equity market.

“We see recent softness driven by higher oil prices as an opportunity to raise exposure. Valuations are expensive but will likely remain so in a scenario of government continuity. A cyclical slowdown from a high base is expected, but it will unlikely deter investor optimism. Intense politicking into the May 2024 elections, China’s re-rotation, and sustained high oil prices are potential risks,” the brokerage said.

JP Morgan recently announced India’s inclusion in its flagship GBI-EM index.

“The opening up of the sovereign bond market and resultant inflows are likely to be beneficial for Indian equity returns due to the positive impact on growth and likely softening implications on interest rates, which will accentuate the case for India’s return correlations to decline,” said Morgan Stanley in a recent note.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.