The rally in Indian equities in 2023 was a good opportunity taken by venture funds and private equity firms to make profitable exits and according to Nuvama Research, PE exits worth ₹97,500 crore were seen during the year. In 2022, PE exits worth ₹91,700 crore were recorded.

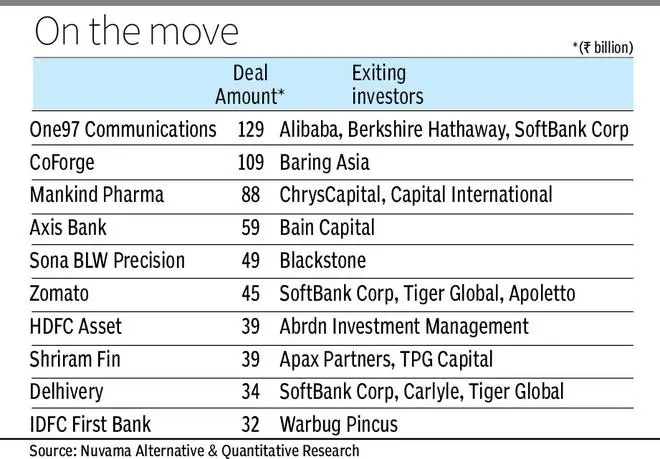

There were 78 companies in which PE firms sold stakes in 2023 and the most high profile and largest of these were Paytm, Coforge, Mankind Pharma, Axis Bank and Sona BLW.

In terms of sectors, the most stake-sales were seen in the financial services sector, accounting for 45 per cent of the total, followed by consumer discretionary at 18 per cent, and information technology, healthcare and industrials.

Last year saw an unprecedented number of block deals hitting the market and a majority of the exits were through block-deal windows.

Broad rally

In 2023, the benchmark indices such as the BSE Sensex and the Nifty50 gained 19-20 per cent. But the real rally was in the broader market with the mid-caps and the small-caps surging 47-56 per cent.

About 80 per cent of all deals were in the mid-cap and small-cap space.

About half of the deals (₹48,700 crore) were in mid-cap companies, while about 30 per cent were in small-caps. Large-cap exits accounted for the remaining 20 per cent.

Foreign funds

Foreign-backed funds saw the rally as the right opportunity to exit and make returns for their investors. They accounted for 79 deals worth ₹81,200 crore, while India-dedicated investors accounted for the rest.

The average deal size was around ₹1,000 crore for the foreign PEs and ₹300 crore for the Indian ones.

The data shows that in many of the companies, more than one of the PE funds backing them chose to sell down their stakes or exit them totally.

The exits were not only in companies that have been listed for some time but relatively newer entrants as well such as Delhivery, Honasa Consumer, Campus Activewear and so on. The exits were done over several transactions during the year.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.