Market regulator SEBI is now going behind the corporate veil of the foreign portfolio investors in the aftermath of the allegations that have emerged against Adani Group.

In India, it has been noticed that in a large number of cases, the foreign portfolio investors (FPIs) are just the registered vehicles, but the ultimate beneficial owners (UBOs) of their positions are hidden.

SEBI’s mandate

Sources say that SEBI has set a deadline of September 2023 for the FPIs to divulge the UBOs of their funds. SEBI’s mandate comes even as the share price of Adani Group is yet to regain its calm after the massive fall that began on January 25.

SEBI has directed the designated depository participants (DDPs), which are mainly custodian banks that act as a link between the FPIs, SEBI, and investors, to update the list of UBOs. The names of the UBOs have often been a sensitive subject for the Indian stock markets since FPIs prefer to keep them hidden from the public. But world over, the money laundering norms are forcing regulators to lift the corporate veil.

SEBI has threatened the DDPs that their FPI licences will be cancelled if they do not divulge the UBOs, and their positions will have to be wound up by March 2024. SEBI has asked all the DDPs to update the details of UBOs of all the FPIs registered in India.

Uncompromising stand

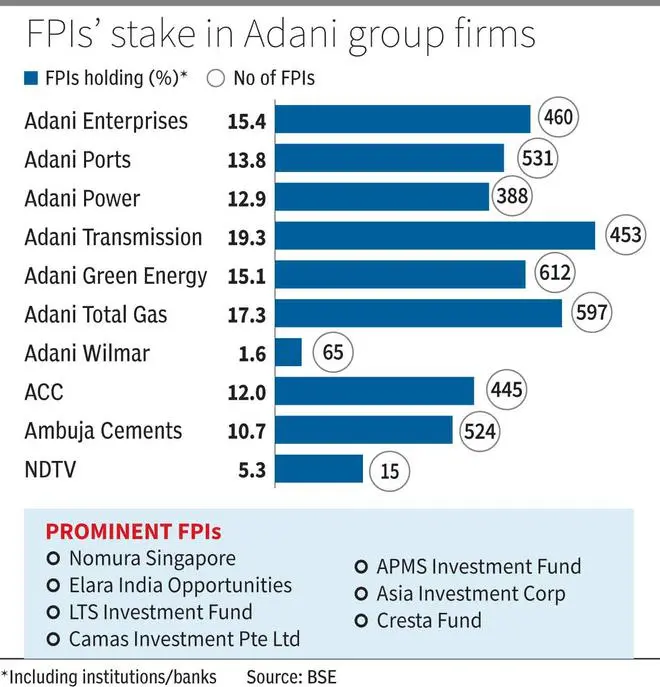

SEBI’s directive assumes importance in light of the controversy surrounding the recent rout in the Adani Group shares. Also, Adani Group has been surrounded by controversies with regard to its FPI holdings. Often, there have been allegations against many Indian corporates that they had kept FPIs investing in them had concealed UBOs, who could be sensitive persons.

Sources say that SEBI has now taken an uncompromising stand on UBOs.

KYC rule

There is a set KYC rule that FPIs have to follow in terms of disclosures, mainly on beneficial owners (BO). SEBI has given custodians the authority to register FPIs, and these FPIs have to keep their list of BO ready when required. NSDL, when it receives complaints or information on suspicious FPIs, seeks a list of BO from them. When there is no response, NSDL freezes their account until the information sought is received.

“Lawyers say that accounts can also be frozen for simple violations such as not linking PAN with bank accounts. SEBI or NSDL has to come out with the facts in the case since it impacts hundreds of shareholders,” said a market expert.

As per SEBI rules, if none of the investors in the FPI crosses the 10 per cent threshold, the statutorily mandated barrier, to be identified as the owner of the FPI, then ownership or control of the FPI will rest with its senior managerial personnel, who have to be clearly identified as the beneficial owner.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.