The Securities and Exchange Board of India (SEBI) plans to take measures to prevent inter-bidding between different investor categories during initial public offerings (IPOs).

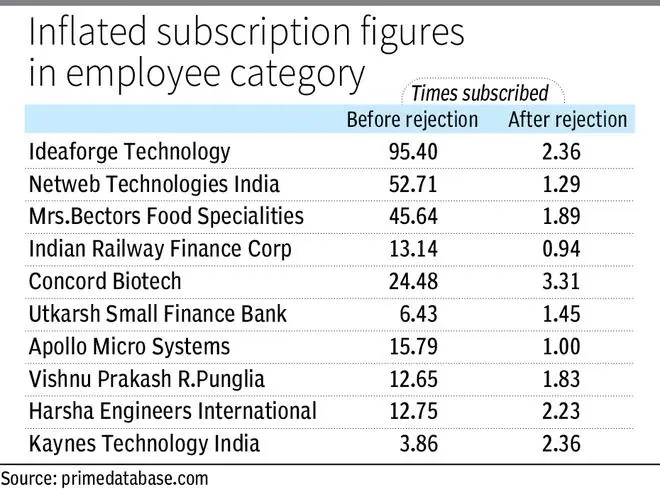

Several offerings in the past have seen a high number of applications getting rejected during allotment, especially in the employee category. This could be because several investors from the retail or non-institutional quota are placing their bids in the employee category inadvertently or to inflate subscription numbers. A number of applications could be from mule accounts.

At present, stock exchanges accept all applications as there is no real-time mechanism to verify whether the person applying is an employee or not. At the time of allotment, however, a lot of these applications get rejected.

For instance, the Ideaforge Technology IPO saw its employee quota get subscribed over 95 times. This later came down to 2.36 times at the time of allotment (see table).

“A lot of non-employees put in applications in the employee category which results in inflated figures and bids getting rejected at the time of allotment. This is a bit puzzling; it can’t be that so many retail or wealthy investors are bidding in the wrong category,” said Pranav Haldea, Managing Director, PRIME Database.

SEBI may ask companies to provide for employee data prior to issue opening so that only eligible employees can bid for the particular category, said an official who tracks the IPO process.

“At present, there is no restriction for a person to place bids in the retail, NII or employee category. The regulator is mulling measures to prevent such inter-bidding among categories,” the official said.

An email sent to SEBI did not immediately get a response.

In June, exchanges had issued a circular regarding systemic improvements in the bidding process of SME issues. Accordingly, the exchange’s book building platform will now verify applicant eligibility prior to bid acceptance in the employee, shareholder and policyholder categories based on details shared by the company or issuer. Such details have to be provided at least one day prior to the issue open date.

“Stock exchanges should stop publishing subscription numbers at the time the book is being built, except maybe for qualified institutional buyers. Let the final figures come post allottment. The entire process needs to be automated so that the work of matching the employee PAN and other details happens at the time of bidding, and not later,” said Haldea.

In January, the regulator said it had found evidence of inflated IPO application numbers in at least three instances recently and wanted to avoid a repeat of the Roopal Panchal scam, where a large number of IPO applications were filed through fictitious demat accounts.

“The IPO applications are filed in a manner that they get rejected. This is done to make the subscription numbers look good. In the interest of investors we will review both policy and enforcement actions in such areas,” Sebi chairperson Madhabi Puri Buch had said at an industry event.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.