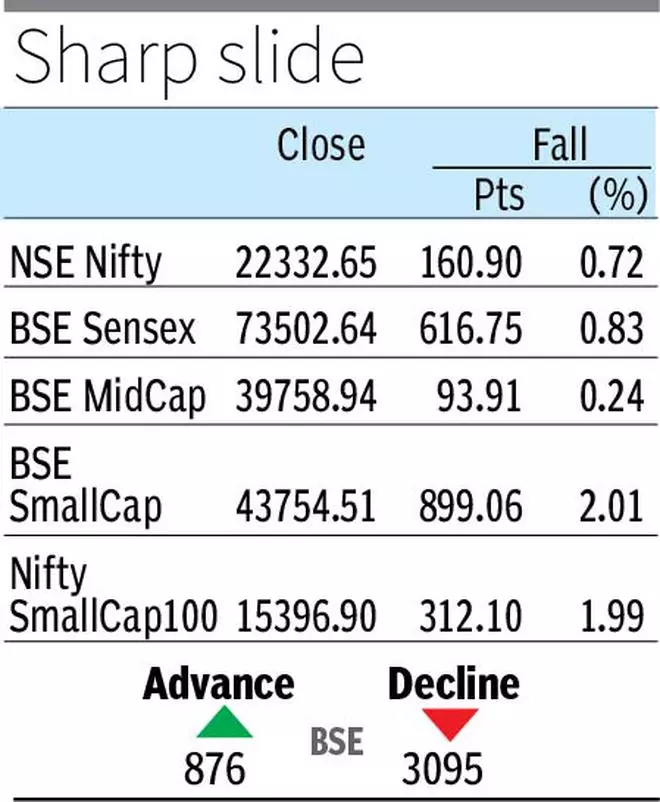

Broader market came under heavy selling pressure on Monday, amid talk of potential bubble in the small- and mid-cap segments and stiff valuation. The BSE Sensex and NSE Nifty declined around 0.7-0.8 per cent while the slide was deeper in the case of BSE SmallCap that plunged 2.01 per cent.

Also read: There are pockets of froth in mid-, small-caps that can build into a bubble: SEBI chief

The fall was evident as 3,095 stocks declined as against just 876 that advanced in today’s trade. As many as 193 stocks hit 52-week high, while 105 stocks hit 52-week low.

Mahadev betting case

Small-caps have been under pressure ever since the Enforcement Directorate frozen accounts associated with Dubai-based hawala operator Hari Shankar Tibrewala, as part of its investigations into Mahadev Online Book illegal betting case, said market experts.

According to the ED, Tibrewala has been laundering the proceeds from the betting operations by investing the money in shares of companies listed on the BSE and NSE.

“ED is investigating a case against “Mahadev Online Book”, which is an umbrella syndicate arranging online platforms for enabling illegal betting websites to enrol new users, create user IDs and laundering of money through a layered web of benami Bank accounts,” the investigating agency said in its X post a few days back.

Also read: SEBI expands framework for qualified stock brokers

“The broader market continued its underperformance due to valuation concerns, while investors are rebalancing their portfolios to include safe haven assets like gold,” Vinod Nair, Head of Research, Geojit Financial Services, said.

Interestingly, both foreign portfolio investors and domestic institutions were buyers in today’s trade. According to provisional data on exchanges, FPIs bought equities worth ₹4,212.76 crore and DIIs ₹3,238.39 crore on Monday.

SEBI Chairperson Madhabi Puri Buch said there are pockets of froth in the small- and mid-cap space in the equity markets that has the potential to become a bubble and burst affecting investors.

Top gainers, top losers

Within the Sensex pack, Nestle India (2.05 per cent), Bajaj Finserv (1.09 per cent), Bajaj Finance (0.57 per cent) and TCS (0.28 per cent) were the top gainers, while Power Grip Corporation (2.41 per cent), Tata Steel (2.38 per cent), SBI (1.86 per cent) and IndusInd Bank (1.53 per cent) were the top losers.

Except the healthcare, all the sectoral indices have declined, with BSE Telecommunication leading the losses with a 2.40% drop.

‘Switch to large-caps’

Siddhartha Khemka, Head-Retail Research, Motilal Oswal Financial Services Ltd, said, “Sentiments dampened after the SEBI Chief highlighted irrational run-ups and expensive valuations in small- and mid-caps. Also, stress test disclosures for small- and mid-cap funds are to be announced on March 15. This is likely to keep the pressure on the broader market in the near-term.”

Also read: Market dips slightly, SEBI implements measures to curb small cap overvaluation

“Going ahead, we expect the consolidation to continue in the market with large bouts of volatility. We recommend switching to large caps where the risk-reward is more favourable,” he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.