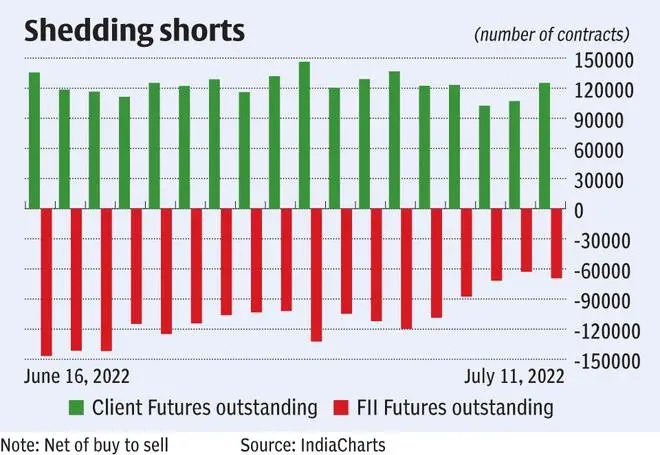

Even as negative sentiment rules most retail stock market investors, resigned to bad news all round, foreign portfolio investors (FPIs) have reduced their bearish bets by nearly 50 per cent, data shows.

As of June 16, FPIs held short positions of 1.46 lakh contracts in the index futures segment on the National Stock Exchange, which fell to a low of 62,000 contracts on July8. Since then, it has risen only marginally . During the same time, the Nifty index rallied by nearly 5 per cent from an intraday low of around 15,200 to touch the 16,100 level on Monday.

Oversold market

Experts say the markets were hugely oversold and just increasing bearish bets on bad news alone was not making enough sense. “There is no dearth of bad news. There is too much negativity in the markets and when the sentiments go from bad to worse, the markets stop falling. It is vice versa of how markets peak in euphoric times. That is what has happened,” said Rohit Srivastava, Strategist, IndiaCharts.

The short positions here are net of long FPI index futures minus the net of short. Going short on the markets or taking a bearish bet means selling index futures in anticipation that the markets will fall; traders make a profit from the price difference. Covering short positions simply means squaring or buying back the futures positions that were sold earlier. A high amount of short covering takes the markets higher, regardless of the bad news.

According to Srivastava, not only FPIs but even a large number of high networth individuals (HNIs) have been riding the upside wave in the markets currently. Experts say the fact that global crude oil and natural gas prices have come sharply off their peaks in the past 20 trading sessions is likely to have triggered a short-covering in the markets, as it would stay the hands of central banks, especially the US Federal Reserve, from raising rates aggressively.

“FPI short positions declined by more than 50 per cent but the other segment that is classified as clients as the exchange data (mainly domestic traders) have held on to their long positions and these are mainly large clients or proprietary traders.

Long index futures positions of clients stood at around 1.25 lakh contracts and is down by only 20,000 contracts from 1.46 lakh. This is typically a technical bounce where bad news has stopped having a major impact on the markets, thereby forcing FPIs to cover their shorts,” said Srivastava.

Where are the markets headed in the near future?

According to Srivastava, a 61.8 per cent retracement of the entire fall from April could take the Nifty index near 17,000 levels till the FPI short positions get covered fully.If the fall in the rupee against the dollar is halted by the slew of recent RBI measures , it would also aid in the continuation of the rally in equities.

Net buyers

Data shows that so far in July, FPIs have been net buyers in the index futures segment of ₹169 crore and not sellers. Between July 5 and 8, FPIs bought index futures worth ₹4,666 crore. In the stock futures segment, FPIs were buyers for ₹1,044 crore. In the cash markets, FPIs are still selling with net sales at ₹6,279 crore so far in July.

In the US markets, data from the CFTC S&P 500 shows that speculators were long 34,000 contracts on June 17 but are now 183,000 contracts indicating the extreme bearish sentiment, which would likely trigger a short covering rally. IndiaCharts says that short positions in the US increased consistently over the last three weeks and this also reflects the peak negative sentiment on the street since it is the largest build-up in bearish bets in S&P futures since June 2020.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.