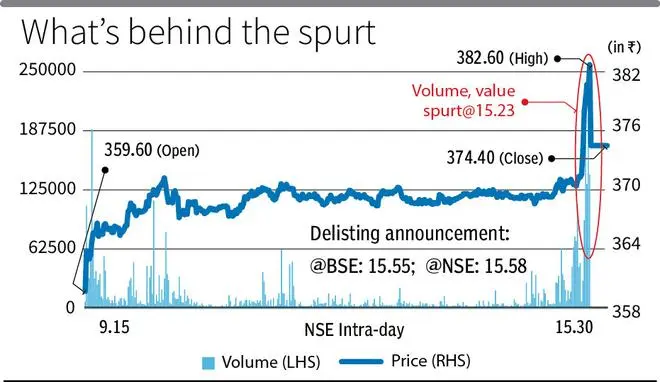

Shares of Tata Motors DVR spiked sharply minutes before the company announced its decision to kill shares with Differential Voting Rights (DVR), raising suspicion of insider trading. Tata Motors’ DVRs were trading around the ₹370 mark through the day but suddenly shot up 3 per cent a few minutes ahead of the market close with higher volumes. About fifteen minutes later, Tata Motors made the disclosure to the stock exchanges that it was going to offer normal shares to investors for the holding DVRs.

“Normally, such rallies are seen when information is leaked in advance to some investors. But in the case of Tata Motors, SEBI will have to investigate to find out if there was any insider trading or not,” said a Mumbai-based stock broker.

The DVRs currently trade at a significant discount to ordinary shares. Tata Motors’ ordinary shares closed at ₹639.45 on Tuesday at the BSE, while the DVRs closed at ₹373.10. The company said it will issue seven ordinary shares for every 10 DVRs held by the investor.

Tata Motors Ltd has two types of listed equity securities, namely Ordinary Shares and ‘A’ Ordinary Shares (DVRs). DVRs carry 1/10th of the voting rights of ordinary shares and are entitled to a five percentage points higher dividend.

The DVR shares were first issued by TML in 2008, and subsequently in a further QIP in 2010 and a rights issue in 2015. Regulatory changes have since restricted the issuance of such instruments with differential voting rights, and TML remains the only large listed corporate with such an instrument.

Also read: Back in the black. Tata Motors Q1 consolidated net profit at Rs 3,301 crore

“The Capital Reduction Consideration implies a 23 per cent premium on the previous day’s closing share price of ‘A’ Ordinary shares, translating to a 30 per cent discount over the ordinary share price and significantly below its historical averages. The Scheme will lead to a reduction in the outstanding equity shares by 4.2 per cent, making it value accretive for all shareholders, “ Tata Motors said in a statement

The Scheme also envisages the creation of a Trust with an independent third party acting as a trustee to operationalise the scheme.

“We are keen to simplify our capital structure. The challenge of DVR shares is that the instrument lost its charm in 2010, when the regulator had concerns about the use of the instrument. We tried infusing liquidity while the discount started averaging 48 per cent. The issue was raised by DVR holders in the meeting. Therefore, the solution to the problem was to cancel all ‘A’ ordinary shares and give them ordinary shares. This is fair for both ‘A’ ordinary shareholders and ordinary shareholders,” said PL Balaji, Group Chief Financial Officer, Tata Motors

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.