A man stands in front of a logo of the Securities and Exchange Board of India (SEBI) headquarters in Mumbai

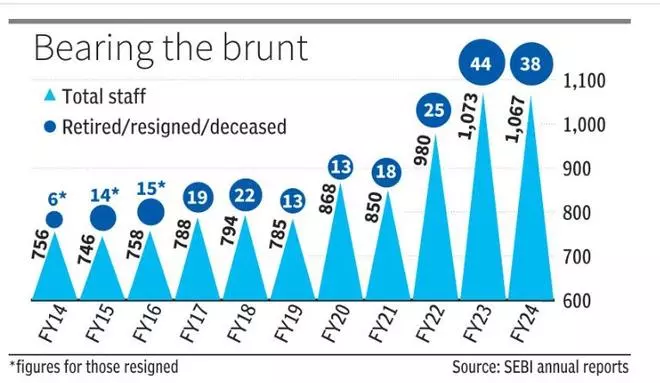

The Securities and Exchange Board of India has lost 82 people by way of resignations, retirement and death in the past two financial years, hinting at a slight uptick in exits after the change in leadership two-and-a-half years ago.

The figure was 38 for FY24 and 44 for FY23, mostly from the assistant general manager, manager and assistant manager grades, data from the regulator’s annual report show. This is higher than any of the previous nine years for which data is available even after accounting for the increase in staff strength. Comparable figures for FY21 and FY22 stood at 25 and 18, respectively, while the previous two fiscals combined saw a reduction of 26 personnel.

The numbers assume significance given the backdrop of a recent email sent by 500 SEBI employees to the Finance Ministry, accusing the top leadership at the regulator of creating a toxic work culture, setting unrealistic targets and micro-management of employees. Employees have also demanded a 55 per cent increase in house rent allowance and updation of the management information system for key result areas.

SEBI, for its part, has said that claims of unprofessional work culture at SEBI are misplaced and are not endorsed by any of its employee associations. Such claims, the regulator said in a release, seemed to stem from disgruntled “junior officers” misled by external elements.

Miffed by the five-page rebuttal addressed to the media, however, SEBI employees held a second protest outside their office premises last week.

An email sent to SEBI on the reasons for the higher number of exits in the past two fiscals did not get a response.

To be clear, the regulator’s attrition rates remain well below 5 per cent despite the recent uptick in exits. Working at SEBI has been viewed favourably, especially by young professionals wanting to make inroads into the financial services industry.

SEBI recruited 25 grade A officers in the legal department in FY24. Another drive to recruit 97 officers across various streams is expected to get completed in FY25. The regulator is also running a young professional programme with an aim of hiring a 20-somethings for one to three years to assist in matters related to the securities market and information technology.

Published on September 10, 2024

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.