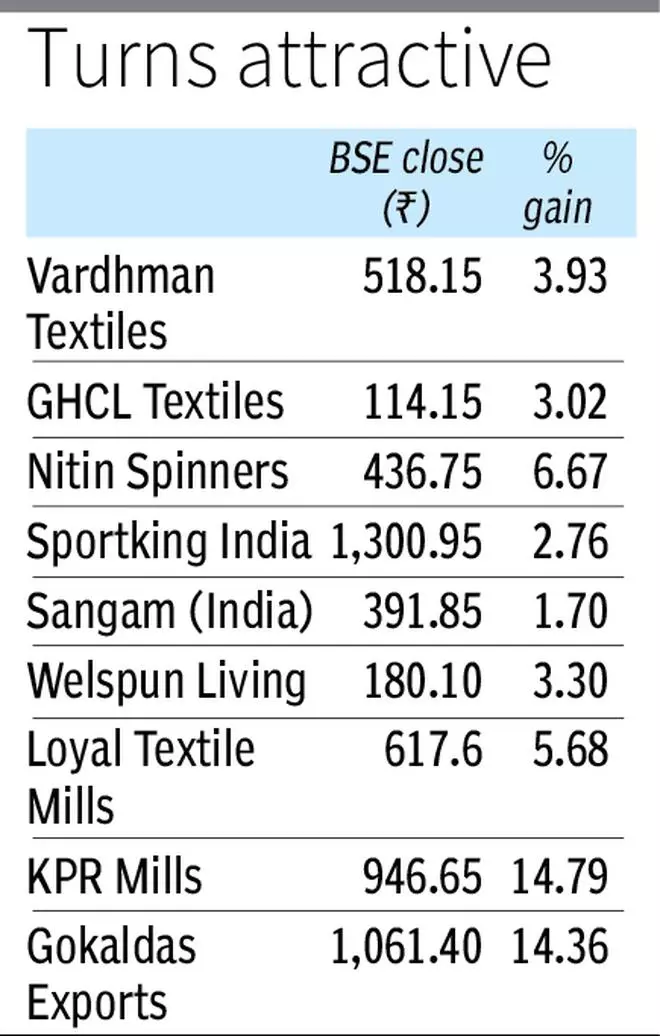

The Bangladesh crisis has driven the stock prices of India’s major spinning and textile companies on an upward trajectory on Tuesday. Companies like Vardhman Textiles, KPR Mills, GHCL Textiles and Sportking experienced substantial gains during the day.

V Nagappan, a stock analyst, commenting on the increase in stock prices of various textile and spinning companies says, “Many of them have begun performing well with new and dynamic management unlike in the past where the owners were like Zamindars and their lieutenants running the show. NexGen is doing better. Bangladesh uncertainty adds to FDA issues.”

The increase in stock price was anticipated due to the expectation that many foreign buyers would now be looking at India as a China Plus policy, said a source. Bangladesh has built a strong garment industry over the past decade. It holds an edge over India in the global readymade garments market, which was valued at around $1,110 billion in 2023.

Trade impact

India’s exports of readymade garments (RMG), including cotton accessories, stood at $16 billion in FY23. In comparison, Bangladesh’s RMG exports topped $47 billion, according to data on the web.

It is unfortunate to note the internal turbulence in Bangladesh. As a dominant player in apparel exports, the concern over timely delivery from Bangladesh may lead to order diversion to countries like India particularly for cotton apparel. “We have some spare capacity available in India to handle an additional 20 per cent of orders immediately,” said Prabhu Dhamodharan, Convenor, Indian Texpreneurs Federation, Coimbatore.

Sector impact

In yarn and fabric exports, with Bangladesh being a major buyer of Indian cotton yarn and fabrics, the spinning sector may face short-term issues. A swift recovery in Bangladesh is crucial for these two sectors. Once the businesses resume production, which can happen in a week, demand for yarn and fabric may rebound strongly to manage the Shortages created by the disruption in their spinning sector.

Apparel imports from Bangladesh have already been declining over the past few months, and a further drastic reduction in imports is expected. Consequently, goods may not arrive in time for India’s upcoming festival season. This will help Indian manufacturers to get more orders from domestic retailers, he said.

K Venkatachalam, Chief Advisor of the Tamil Nadu Spinning Mills Association, said that If garment orders diverted to India, the country has sufficient infrastructure to cater for any requirements. This opportunity needs to be capitalised suitably.

A temporary slowdown in yarn sales is anticipated, but it should stabilise in a month or so, said SK Sundararaman, Chairman, The Southern India Mills’ Association (SIMA).

“Bangladesh is the biggest customer for yarn exports as of now. with around 25 per cent to 30 per cent of exports goes to Bangladesh. Any disruption over there will create issues here as well. However, this situation is relatively minor and has not yet impacted demand. But unless it is resolved or it continues for a long period, then there could be a concern. But as of now, there doesn’t seem to be an issue,” Neeraj Jain, Joint Managing Director, Vardhman Textiles Ltd, told analysts while discussing financial results.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.