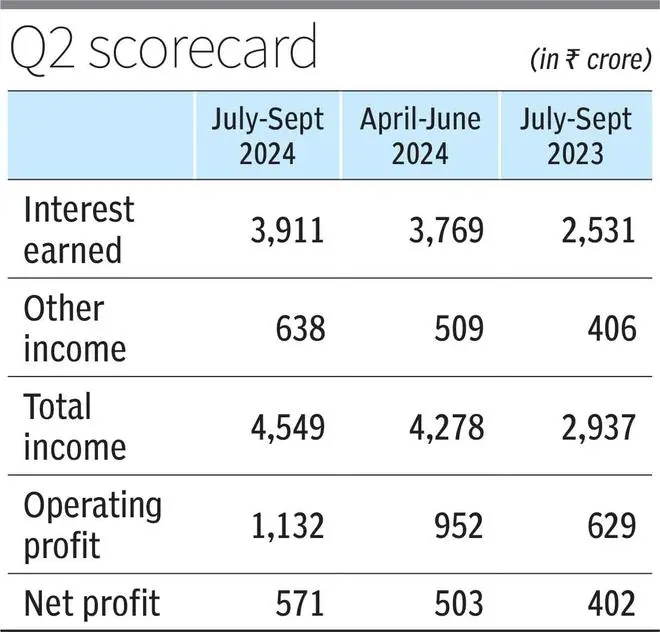

AU Small Finance Bank on Wednesday reported a 42 per cent increase in net profit for the second quarter ended September 30,2024 at ₹571 crore (₹ 402 crore).

The latest bottomline performance is 13.5 percent higher than the net profit of ₹ 503 crore recorded in June 2024 quarter.

Total income for the quarter under review increased 55 percent to ₹ 4,549 crore (₹ 2,937 crore).

For the April-September 2024 period, AU Small Finance Bank reported a net profit of ₹ 1,074 crore, up 36 percent over net profit of ₹ 789 crore in same period last year.

Commenting on the performance, Sanjay Agarwal, MD & CEO, AU Small Finance Bank said, “First half of this financial year saw some discontinuity in business momentum with persistent inflation, general elections and various state elections as well as heat wave and unusual heavy rain in August. We have started to see early signs of pickup in economic activity over the last 3-4 weeks and remain optimistic of an improved operating environment in H2 as consumer confidence, rural demand and private investment picks up”.

Consistent Performance

Amidst this macro backdrop, AU SFB delivered another quarter of consistent performance across most of the parameters with sustainable growth in assets and profitability, he said. “Our double-digit deposit growth on q-o-q basis with stable Cost of Funds remains the highlight of the quarter. We aim to deliver all our articulated strategy of AU@2027 by focusing on our margins, sustained fee income growth and calibrating operating expenses of the book”, Agarwal said.

AU Small Finance Bank had in September applied to RBI for voluntary transition to universal bank which will further improve its brand acceptance with higher perception of safety and trust and thereby enable it for the next phase of growth and buildout of a “forever bank”, he added.

For the quarter under review, Net Interest Margin (NIM) increased by 5 basis points to 6.1 per cent from 6.05 per cent in June quarter.

In the first half of current fiscal, the bank’s net interest margin stood at 6.1 per cent compared to 5.6 percent in same period last fiscal.

While gross loan portfolio crossed milestone of ₹ 1 lakh crore at ₹ 1,05,031 crore, total deposits crossed milestone of ₹ 1 lakh crore to touch ₹ 1,09,693 crore.

AU Small Finance Bank now has total 109 lakh plus customers, serves them through a total 2,408 touch points across 21 States and 4 Union Territories with total strength of about 48,000 employees. Shareholders fund of the Bank has now surpassed ₹ 16,000 crore.

For the quarter under review, Gross Non Performing Assets (GNPA) increased to 1.98 percent (vs 1.78 percent in Q1) and Net Non Performing Assets (NNPA) increased to 0.75 percent (vs 0.63 percent in Q1).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.