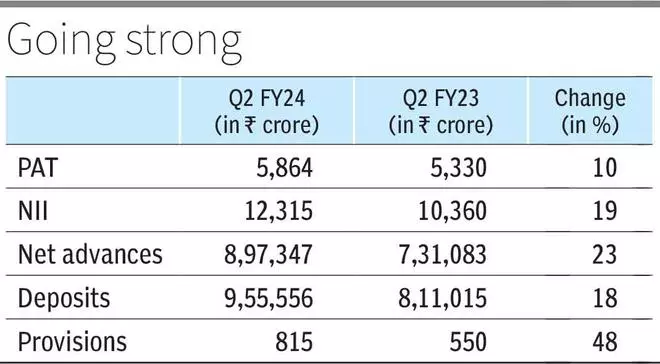

Axis Bank posted a net profit of ₹5,864 crore for Q2 FY24, a growth of 10 per cent on year, in line with industry expectations. Profitability was led by steady margins and strong loan growth, especially in the mid-to-small corporates and unsecured retail segments.

Net interest income (NII) grew 19 per cent y-o-y and 3 per cent q-o-q to ₹12,315 crore. Net interest margin (NIM) for the quarter was at 4.11 per cent, up 15 bps on year and 1 bps on quarter.

In the post earnings call, CFO Puneet Sharma said that cost of funds had increased 14 bps sequentially, which was offset by a similar rise in yield on advances during the quarter. While the bank does expect the legacy deposit base to continue to reprice, the marginal funding cost has stabilised and margins should remain supported, he said.

Deposits grew 18 per cent y-o-y and 1 per cent q-o-q to ₹9.6 lakh crore. Term deposits grew 22 per cent y-o-y, of which retail term deposits were up 15 per cent. The CASA ratio stood at 44 per cent — one of the best in the industry, MD and CEO Amitabh Chaudhry said.

Advances grew 23 per cent y-o-y and 5 per cent q-o-q to ₹9 lakh crore, led by 26 per cent y-o-y and 5 per cent q-o-q rise in domestic loans.

Retail loans grew 23 per cent y-o-y to ₹5.2 lakh crore, of which 76 per cent loans were secured and 31 per cent were home loans. Retail loans accounted for 58 per cent of net advances at the end of September. Personal loans were up 25 per cent, credit cards by 72 per cent and rural loans by 24 per cent.

The management said the focus in unsecured loans is on existing and partnership customers, which remain good sourcing engines for the bank. The bank has chosen to stay away from the low-ticket segment where signs of stress are emerging and currently, there is nothing to indicate heightened risk, they said, adding that growth in this segment is expected to sustain without compromising on credit quality.

Small business banking loans grew 42 per cent, mid-corporate loans by 37 per cent and SME loans by 27 per cent. these segments now constitute a strong growth area for the bank, comprising 21 per cent of total loans, Chaudhry said, adding that overall disbursement pipeline for Q3 looks healthy.

Corporate loans grew 21 per cent yoy and 3 per cent q-o-q to ₹2.8 lakh crore, of which domestic loans were up 33 per cent y-o-y and 4 per cent q-o-q, which reflects that the bank has been running down its foreign currency corporate book, Sharma said.

Deputy MD Rajiv Anand said domestic corporate demand remains strong across sectors, both from a working capital and term loan perspective, and the bank is seeing capex demand from the private sector.

Gross slippages during the quarter were ₹3,254 crore, largely offset by recoveries and upgrades of ₹1,985 crore and loan write-offs worth ₹2,671 crore.

Gross NPA ratio improved to 1.73 per cent as of September 30, a decline of 77 bps y-o-y and 23 bps q-o-q. The net NPA ratio at 0.36 per cent, was 15 bps lower on year and 5 bps on quarter.

Published on October 25, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.