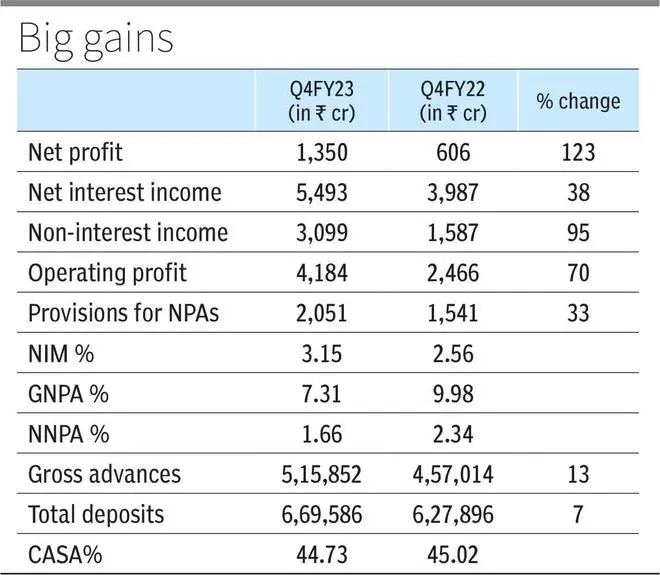

Bank of India’s (BoI) fourth quarter net profit soared 123 per cent year-on-year (y-o-y) to ₹1,350 crore against ₹606 crore in the year-ago quarter. The bottomline in the reporting quarter was buoyed by robust growth in net interest income and non-interest income.

The public sector bank’s board recommended a dividend of ₹2 per equity share of face value of ₹10.

Net interest income (difference between interest earned and interest expended) rose 38 per cent y-o-y to ₹5,493 crore (₹3,987 crore in the year-ago quarter).

NII up 95 pc

Non-interest income (comprising fee-based income, treasury income, and other non-interest income) was up 95 per cent y-o-y at ₹3,099 crore (₹1,587 crore). Within this, profit from sale and revaluation of investments shot up to ₹1,717 crore against a loss of ₹111 crore in the year-ago quarter.

Provision towards “depreciation in non-performing investment” and “standard assets and others” jumped to ₹1,130 crore (₹323 crore) and ₹374 crore (₹83 crore), respectively. However, provision towards “bad and doubtful assets” declined to ₹546 crore (₹1,135 crore).

Gross advances were up 13 per cent y-o-y and stood at ₹5,15,852 crore as at March-end 2023. Total deposits increased by 7 per cent and stood at ₹6,69,586 crore.

GNPAs declined to 7.31 per cent of gross advances as at March-end 2023 against 9.98 per cent as at December-end 2022. Net NPAs declined to 1.66 per cent of net advances against 2.34 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.