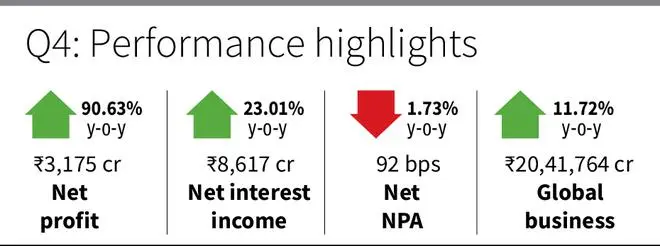

State-owned Canara Bank posted a 90 per cent increase in net profits to ₹3175 crore during the fourth quarter of FY23, compared to ₹1,969 crore in the same quarter last year.

During Q4, the net interest income (NII), which is the difference between interest earned and interest expended, went up by 23 per cent y-o-y to ₹8,616 crore compared to ₹7,006 crore in the corresponding quarter of last year.

The Board of Directors has recommended a dividend of ₹12.00 per equity share (120 per cent) for the year ended on March 31, 2023, subject to requisite approvals, compared to 65 per cent last year.

Asset quality

In terms of asset quality, the Gross Non-Performing Assets (GNPA) ratio was reduced to 5.35 per cent down from 7.51 per cent as of March 2022. The net non-performing assets (NNPA) ratio was reduced to 1.73 per cent as of March 2023, down from 2.65 per cent as of March 2022.

The bank’s global business increased by 11.72 per cent y-o-y to ₹20,41,764 crore with global deposits at ₹11,79,219 crore (8.54 per cent y-o-y) and global advance (gross) at ₹8,62,782 crore (16.41 per cent y-o-y) .

The domestic deposit of the bank stood at ₹10,94,746 crore, with a growth of 6.52 per cent y-o-y and the domestic advances (gross) stood at ₹8,17,762 crore as of March 2023, growing by 15.01 per cent y-o--y .

Its gold loan grew by 33.82 per cent with a portfolio amount of ₹1,23,185 crore and RAM credit grew by 13.23 per cent which constitutes 55 per cent of total advances, while retail credit grew by 10.91 per cent with housing loans at 14.27 per cent.

As of March 31, 2023, the bank has 9,706 branches, out of which 3,048 are rural, 2,742 are semi-urban, 1,991 are urban, and 1,925 are metro, along with 10,726 ATMs. The bank also has three overseas branches in London, New York and Dubai.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.