After dipping slightly in September, credit card spending surged over 25 per cent in October on the back of festival season-led spending to a record high of ₹1.78 lakh crore, according to data by the Reserve Bank of India (RBI).

Card spending increased by 25.47 per cent month, after dipping by 4.23 per cent in September. The previous high was seen in August at ₹1.48 lakh crore.

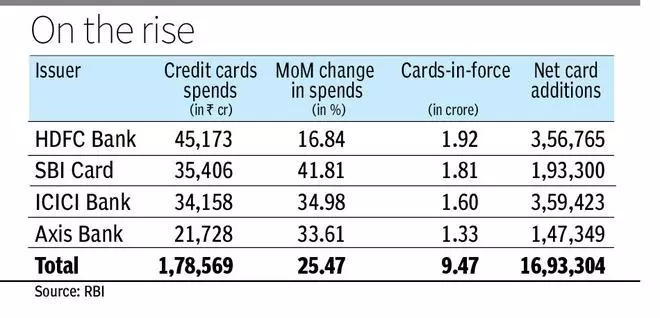

Most major issuers registered a double-digit increase in spending during the month with spending for the top four issuers rising 16-42 per cent. SBI Card saw the highest increase at 42 per cent followed by ICICI Bank at 35 per cent.

Spends had dipped in September as consumers curtailed transactions on expectations of heightened spending during the festival season, which started in October this year, reflected in the spending for the month.

e-commerce dominance

The share of e-commerce payments in credit card spending has been steadily increasing, rising to 67.6 per cent in October from 65.3 per cent in September and 64.4 per cent in the previous month. On the other hand, the share of PoS (point-of-sale) transactions fell to 32.4 per cent from 34.7 per cent last month and 35.6 per cent in August.

Other issuers such as Kotak Mahindra Bank, AU Small Finance Bank, DBS Bank India, Federal Bank, Canara Bank and South Indian Bank also saw spending increase by 17-30 per cent per month. Cards outstanding also at a record high.

Even as spending surged during the month, credit cards-in-force continued to grow at a steady pace. Outstanding cards touched a new high of 9.47 crore cards in October, up 1.8 per cent from the previous high of 9.30 crore cards in September.

The number of credit cards rose by 16.9 lakh during the month, slightly lower than 17.4 lakh in the previous month, due to a decrease in cards for banks such as Indian Overseas Bank, Tamil Nadu Mercantile Bank and SBM Bank India.

Among the top four issuers, ICICI Bank was the leader in terms of increase in number of cards for the third straight month, net adding 3.6 lakh cards during the month to a total of 1.6 crore cards. In September and August, the bank had net added 3.5 lakh and 3.1 lakh cards, respectively.

HDFC continued to maintain its position as the largest card issuer with cards-in-force at 1.92 crore, seeing an increase of 3.5 lakh cards during the month. IDFC First Bank, IndusInd Bank, Kotak Mahindra Bank and RBL Bank were the other issuers to see strong net addition in cards.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.