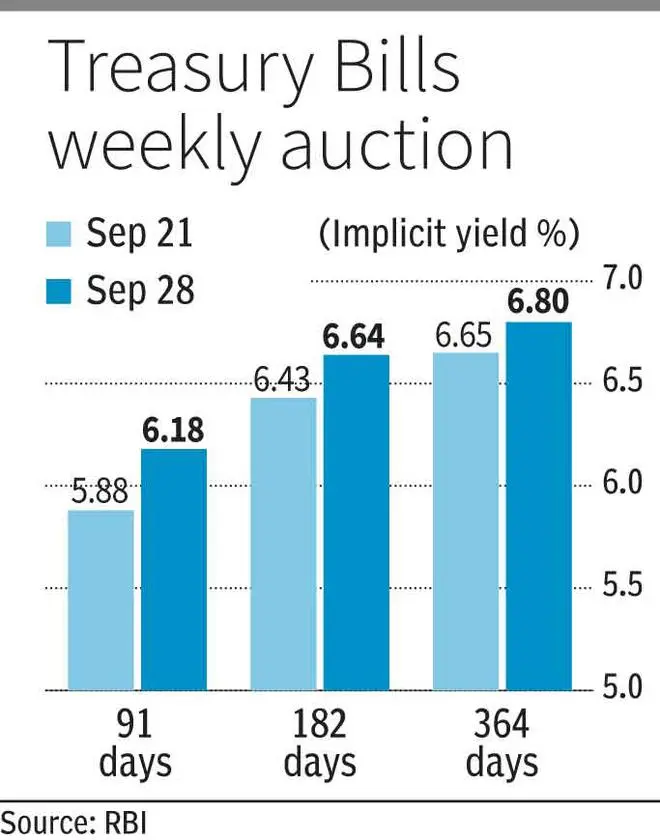

In the run-up to the bi-monthly monetary policy review, the cut-off yield at the weekly auction of Treasury Bills (T-Bills) on Wednesday jumped about 15–30 basis points week-on-week (WoW), further discounting the possibility of a 50 basis point repo rate hike by the Monetary Policy Committee this week.

The cut-off yield on T-Bills at last Wednesday’s auction had risen about 16–24 basis points week-on-week.

MPC decision

The decision of the six-member monetary policy committee on repo rates and monetary policy stance will be announced by RBI Governor Shaktikanta Das on September 30.

Market players expect the repo rate to be hiked by 50 basis points to rein in retail inflation, which at 7 per cent in August was 100 bps above the upper tolerance level of 6 per cent, and control the depreciation of the rupee.

With liquidity in the banking system almost drying up, it is also likely that the monetary policy stance will be changed to neutral from “withdrawal of accommodation”.

Ajay Manglunia, Managing Director and Head of Institutional Fixed Income, JM Financial, observed that the expectation of a rate hike will have a direct impact on short-tenor money market instruments. So, yields on T-Bills have started hardening.

“The rates of money market instruments such as T-Bills, commercial papers, and certificates of deposit, which were about 3.25-3.30 per cent last year, have inched up with rate hikes.

“The short-term rates have priced in the entire cycle of the rate hike. So, 91-day T-Bill rate has moved up from about 3.30 per cent to about 6.20 per cent, up 290 basis points,” he said.

‘Clear signal’

The MPC hiked the repo rate thrice since May 2022, cumulatively by 140 basis points, with the last two hikes being of 50 basis points each.

Referring to the spike in T-Bills auction cut-off yields, Manglunia emphasised that this is a clear signal that this Friday there will definitely be a 40-50 bps repo rate hike.

“Aggressive rate hikes by the US Fed are affecting our currency. So, in order to protect our currency from depreciation and volatility, the RBI will have to increase the repo rate rate,” he said.

Marzban Irani, CIO-Fixed Income, LIC Mutual Fund, noted that liquidity in the banking system has almost dried up.

“Advance tax outflows have happened. So, there is tight liquidity in the market. Plus, RBI’s policy review is due on Friday. So, short-term yields have risen,” he said.

Irani underscored that the market is discounting future rate hikes by seeking higher cut-off yields at T-Bills auctions.

“Suppose we have to buy a T-Bill. We will see how many policy reviews are there in the run-up to its maturity.

“If an investor bids for the 91-day T-Bill at today’s auction, he will assess how many rate hikes could be there during the tenor of the paper—on September 28 and December 7—and accordingly place the bid,” Irani said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.