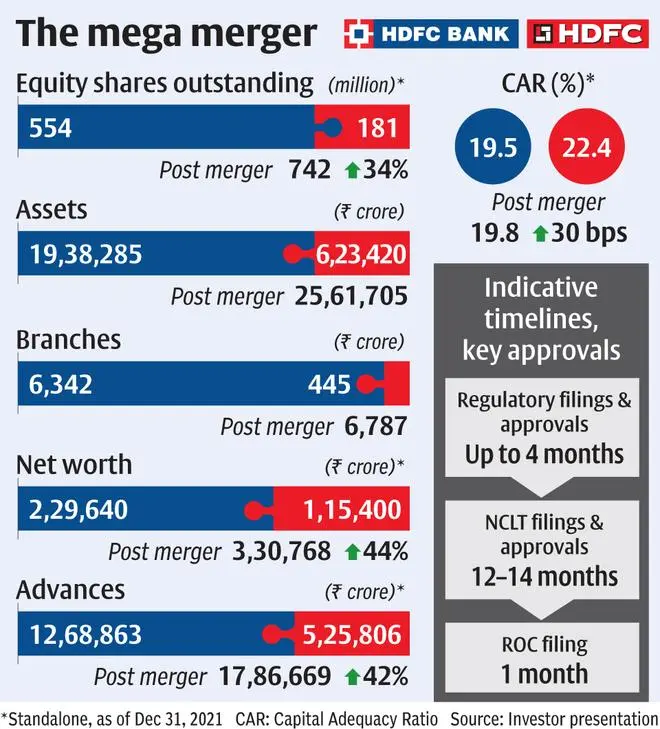

India’s largest housing finance company, HDFC Ltd, will merge with the largest private sector bank in the country, HDFC Bank, to create an entity with a combined balance sheet of ₹17.87-lakh crore and net worth of ₹3.3-lakh crore.

While HDFC Bank will continue to be the second-largest lender in the country after State Bank of India, its size following the merger would be twice that of ICICI Bank, the third largest lender.

The closing of the deal is expected to be achieved within 18 months, subject to regulatory approvals and is likely to be completed by Q2 or Q3 of FY24. Sashi Jagdishan, CEO and MD, HDFC Bank, will be at the helm of the merged entity, and Keki Mistry, the current chief at HDFC, will join as a director on the board of the new company. Deepak Parekh, who has been associated with HDFC since 1978, will step down as chairman.

The board composition will be addressed in discussion with the Reserve Bank of India (RBI), said Atanu Chakraborty, chairman of HDFC Bank.

‘Home for ourselves’

“After 45 years in housing finance, providing 9 million homes to Indians, we had to find a home for ourselves. We have found it within our own family and in our own bank,” Parekh said at a press conference on Monday.

“Over the last few years, various regulations for banks and NBFCs have been harmonised, thereby enabling the potential merger. Further, the resulting larger balance sheet would allow underwriting of large ticket infrastructure loans, accelerate the pace of credit growth in the economy, boost affordable housing and increase the quantum of credit to the priority sector, including credit to the agriculture sector,” he added.

Once the scheme becomes effective, the subsidiaries and associates of HDFC will become subsidiaries and associates of HDFC Bank. Shareholders of HDFC as on the record date will receive 42 shares of HDFC Bank, each of face value of ₹1, for 25 shares held in HDFC Ltd (each of face value of ₹2).

The equity shares held by HDFC in HDFC Bank will be extinguished as per the scheme. The merger will be EPS accretive from the first year itself. HDFC Bank will be 100 per cent owned by public shareholders and the existing shareholders of HDFC will own 41 per cent of HDFC Bank.

RBI approval

According to Macquarie Research, RBI’s approval will be a key monitorable as the merger bank will own 48 per cent in life, 50 per cent in general insurance and 69 per cent in the AMC entities of the group.

HDFC has written to the RBI seeking time and a phased approach for meeting SLR, CRR and priority sector lending. Permission has also been sought for the bank to continue holding a stake in HDB Financial Services and to hold on, and if needed, increase stake in HDFC Life Insurance. These requests are under consideration by the RBI.

Combined entity

“The proposed transaction ticks all the right boxes in terms of completion of product offerings, product leadership in home loans as with other retail assets products, distribution strength and a customer base that can be leveraged to cross-sell a complete suite of financial products,” said Shashi Jagdishan.

Analysts said the merger will result in significant market-share gains for HDFC Bank, given that HDFC is the largest financier of mortgages in India. Samir Bahl, CEO, Investment Banking, Anand Rathi Advisors, termed it the largest and most transformational merger in the Indian financial services sector. “With this merger, HDFC Bank gets an unparalleled advantage through the mortgage portfolio, providing it a quantum leap in distribution to semi urban and rural areas with a huge opportunity to cross-sell bank products,” he said.

S&P Global Ratings said the merger will raise HDFC Bank’s loans by 42 per cent to ₹18-lakh crore, also increasing its market share to about 15 per cent, from 11 per cent at present.

Investors were clearly enthused by the announcement as HDFC scrip closed 9.3 per cent higher at ₹2,678.9 a piece on BSE while HDFC Bank ended at a gain of 9.97 per cent at ₹1,656.45 apiece.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.