India’s largest mortgager, HDFC Limited, has started work on yet another round of massive bond sale.

Highly placed sources tell businessline that the housing financier may raise up to ₹50,000 crore by way of bonds in what could be the last tranche of bond issuance ahead of the merger. The issue is likely to conclude by May and with this, the lender would have concluded ₹1.32-lakh crore of bond issuances ahead of the merger.

In February, it had raised ₹25,000 crore of 10-year bonds and on March 27, the boards approved ₹57,000 crore of bond issuance.

Merger ready

The purposes of raising such heavy liabilities is to ensure that HDFC Limited is merger ready, which is expected to happen in July. Highly placed sources say the mortgager may be permitted to carry forward the bond raised prior to the merger.

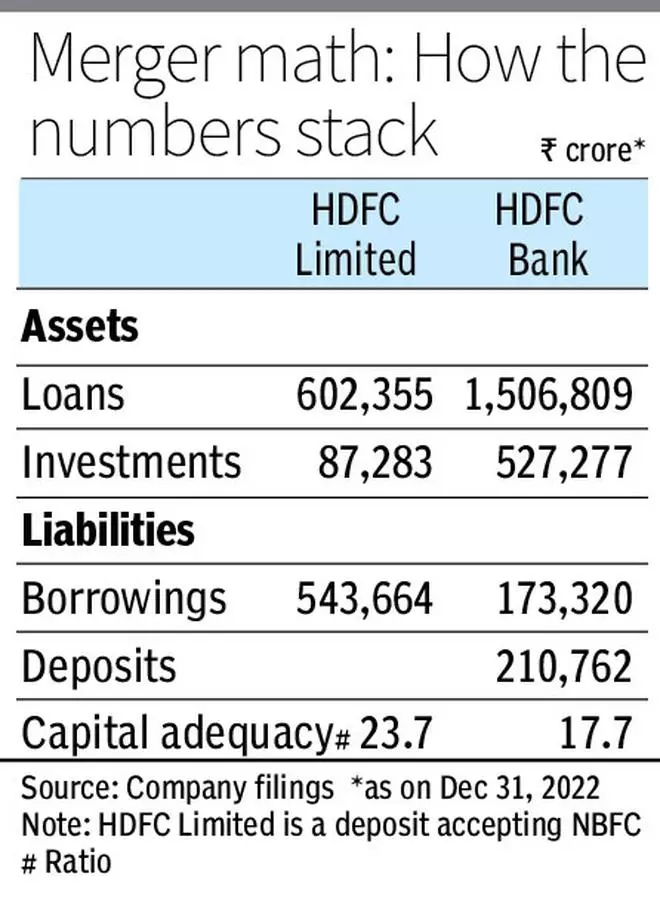

This would take care of a reasonable proportion of asset liability management (ALM) when the books of HDFC Limited is merged with the bank’s financials. If the Reserve Bank of India allows grandfathering of these bonds, it would substantially ease the pressure on HDFC Bank to raise deposit. Also, in case the bank doesn’t get any leeway on the requirement of maintaining cash reserve ratio and statutory liquidity ratio, grandfathering of these bonds be handy in handling the ALM.

Also read: HDFC board clears raising ₹57,000-crore through non-convertible debentures

“Right now, the bank is approaching the merger with the assumption that there would be no dispensation from the regulator on the reserve ratios,” said a person aware of the matter. HDFC Limited did not respond to a mail seeking clarification.

Some respite likely

Where the bank could possibly get some relief is on the priority sector loans (PSL), according to sources. The requirement for PSL would be computed based on past year’s balance sheet of the combined entity.

It is leant that post the merger, the regulator may allow the bank to shore up these requirements though various instruments such as PSL certificates, securitisation arrangements and inter-bank participation certificates and so on, rather than meeting the requirements organically. For now, HDFC Bank and HDFC Limited are working towards concluding the merger by end of June.

“It would benefit both of them if the merged entity comes to place by July 1,” said a source aware of the matter. The merger was announced April 4, 2022. HDFC Bank received a no-objection letter from the RBI on July 4, 2022, and the NCLT approval came through on March 17, 2023.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.