The Reserve Bank of India, along with NPCI International Payments (NIPL), will in FY25 begin work towards taking UPI to 20 countries with a completion timeline of FY29, the central bank said in its annual report for FY24.

“The steady stream of innovations has enhanced UPI’s usefulness and ease of use, which has resulted in UPI becoming the single largest retail payment system in terms of volume of transactions,” the report said.

UPI offers features such as UPI123Pay, UPI Lite on-device wallet, linking RuPay credit cards to UPI, and processing mandates with single-block-and-multiple-debits. In FY24, additional features such as conversational payments, offline transactions using near field communication (NFC) technology, and pre-sanctioned credit lines from banks were added to the payment channel.

The central bank will also explore multilateral linkages and opportunities for collaboration of Fast Payment System (FPS) with a group of countries like European Union and South Asian Association for Regional Cooperation (SAARC).

Other focus area

Another area of focus will be exploring alternative risk-based authentication mechanisms leveraging behavioural biometrics, location/ historical payments, digital tokens, and in-app notifications. Currently, the payments ecosystem largely relies on the SMS-based one-time password (OTP) as additional factor of authentication (AFA).

“However, with the advancements in technology, various innovative solutions are now available to address the fraud and friction in payments,” the RBI said, adding that it will also explore the introduction of real-time payee name validation before fund transfers.

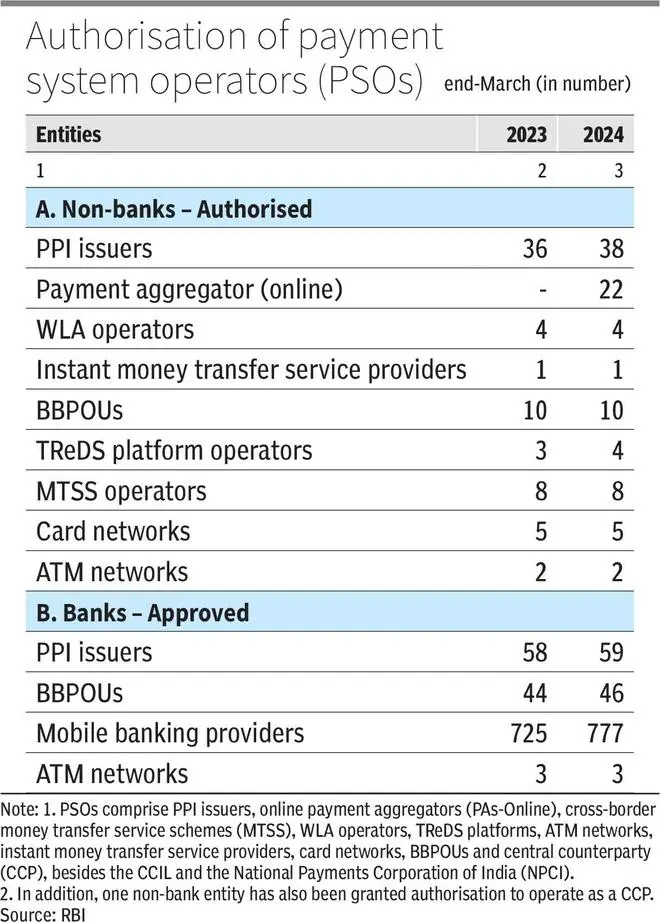

The central bank authorised 22 online payment aggregators (PAs), two non-bank Prepaid Payment Instrument (PPI) issuers and one Trade Receivables Discounting System (TReDS) platform operator in FY24, and in-principle authorisation to a few other online PAs, PPIs, one white label ATM (WLA) operator and one TReDS platform operator. It also approved one bank for PPI issuance, two banks for operating as Bharat Bill Payment Operating Units (BBPOUs), and 52 banks for providing mobile banking facility to their customers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.