The Reserve Bank of India upped the repo rate by 25 basis points on Wednesday. The monetary policy committee (MPC) voted by a 4:2 majority to arrive at this decision, even as stickiness in core inflation has become a matter of concern.

While the rate hike from 6.25 per cent to 6.50 per cent is in line with market expectations, RBI Governor Shaktikanta Das’ observations that “we need to see a decisive moderation in inflation”, probably indicates that MPC is not done with the cycle yet.

Das said the headline inflation has moderated with negative momentum in November and December 2022, but the stickiness of core or underlying inflation (which excludes changes in food and energy prices) is a matter of concern. Retail inflation moderated by 105 bps during November-December 2022 from 6.8 per cent in October.

“We need to see a decisive moderation in inflation. We have to remain unwavering in our commitment to bring down inflation. Thus, monetary policy has to be tailored to ensuring a durable disinflation process. A rate hike of 25 bps is considered appropriate at the current juncture. The reduction in the size of the rate hike provides the opportunity to evaluate the effects of the actions taken so far on the inflation outlook and on the economy at large,” Das said.

The MPC also voted by a 4:2 majority to remain focused on the withdrawal of accommodation to ensure that inflation remains within the target, while supporting growth.

“The Indian economy remains resilient... inflation has shown signs of moderation and the worst is behind us. But there are concerns around core inflation. We cannot take our eyes off,” said the Governor.

Inflation, GDP projections

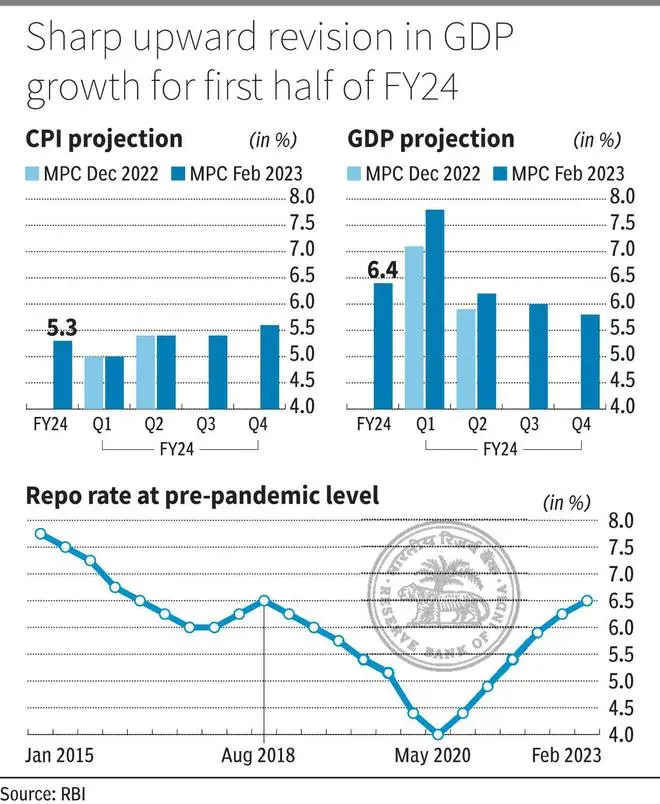

The central bank also revised its FY23 retail inflation projection lower to 6.5 per cent (6.7 per cent earlier), and for Q4 at 5.7 per cent (5.9 per cent). Further, on the assumption of a normal monsoon, retail inflation has been projected at 5.3 per cent for FY24 — Q1 at 5 per cent, Q2 at 5.4 per cent, Q3 at 5.4 per cent and Q4 at 5.6 per cent — with risks evenly balanced.

“While inflation is expected to moderate in 2023-24, it is likely to rule above the 4-per-cent target. The outlook is clouded by continuing uncertainties from geopolitical tensions, global financial market volatility, rising non-oil commodity prices and volatile crude oil prices,” Das said.

The RBI has projected real GDP growth for FY24 at 6.4 per cent — Q1 at 7.8 per cent (7.1 per cent earlier), Q2 at 6.2 per cent (5.9 per cent), Q3 at 6.0 per cent and Q4 at 5.8 per cent — with risks evenly balanced. Das cautioned that weak external demand and the uncertain global environment however, would be a drag on domestic growth prospects.

‘Hawkish tone’

AK Goel, Chairman, Indian Banks’ Association, said: “Evidently, the policy is focused more on managing inflation, even though the recent retail inflation readings are showing signs of moderation. RBI has given considerable emphasis on high core inflation pressures and assumes it as a major risk to the growth outlook.”

HDFC Bank, in a report, observed that the policy tone was more hawkish than what most market participants expected as the RBI recognised that they are still away from achieving their objective of durable disinflation. Going forward, the central bank is likely to become more data dependent and this does not rule out another rate hike in the upcoming policy, it added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.