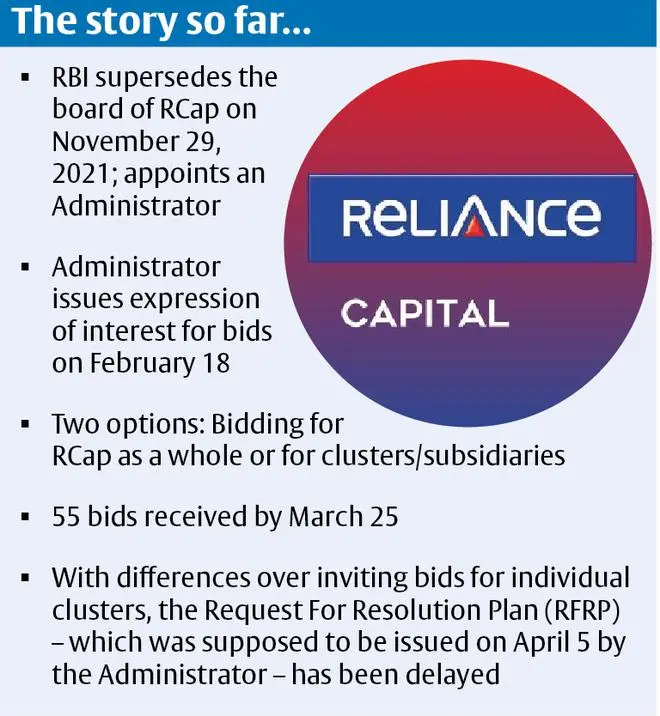

The debt resolution process of Reliance Capital (RCap) has hit a hurdle with differences arising between the RBI-appointed Administrator and the Committee of Creditors over the sale of some of the profit-making subsidiaries of the non-banking finance company.

Under the resolution plan, potential bidders have two options to acquire the assets of RCap. They can either submit a bid for the whole of Reliance Capital under option one or bid for different clusters or subsidiaries under the second option. As many as 55 entities including YES Bank, Piramal consortium, Adani Finserve, Brookfield, Bandhan Financial Holdings and Blackstone have submitted an expression of interest to acquire the company. Nearly two dozen players have expressed interest to bid under both options, others want to bid only for selected clusters or subsidiaries such as Reliance General Insurance, Reliance Health Insurance, Reliance Nippon Life Insurance, and Reliance Asset Reconstruction, and Reliance Securities. According to banking sources, differences had cropped up between the Administrator and Committee of Creditors of Reliance Capital over the resolution process for the company’s subsidiaries.

According to a second source, differences had arisen on whether to invite price bids for individual clusters under the second option. Another concern was whether cluster level bids under the second option could submit a plan compliant with the Insolvency and Bankruptcy Code.

“All the subsidiaries or clusters are profit making entities and are well capitalised. So, there is no requirement of turnaround since none of these entities are facing any stress and are well run businesses,” said the source.

Related Stories

Reliance Capital: CoC may seek a 90-day extension to complete resolution

Most lenders favour extending the deadlineAccording to the IBC, no compliant plan can be submitted under the second option as there is no requirement for a turnaround.

“Under the circumstances, only the first option of RCAP level plans can be considered and approved under the IBC,” the source noted.

As a result of this difference the Request For Resolution Plan, which was supposed to be issued on April 5 by the Administrator, has been delayed.

Sources close to the resolution process said the issues are being discussed between the CoC and the Administrator and the RFRP is now likely to be issued in the second week of April. RFRP document sets the guidelines for submission and evaluation of the resolution plan and it has to be agreed upon between the Administrator and CoC before it is published to all potential bidders.

“There have been discussions on the best way for monetisation of the assets. There were a few points which have been clarified and the modalities for the RFRP are now under discussion,” said a source close to the development, adding that it is likely to be issued shortly.

Consortium formation

According to the first source, CoC is keen on consortium formation for cluster-level bidders but the Administrator may not be in favor of this. “Now, the resolution may be taken up for the whole of Reliance Capital, under both the options,” said the source. If this happens, the number of bidders would drop considerably as those who want to acquire only specific subsidiaries maybe left out of the race.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.