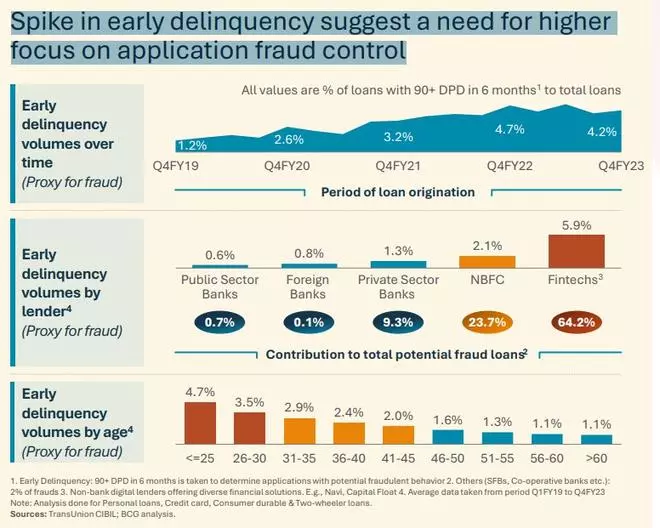

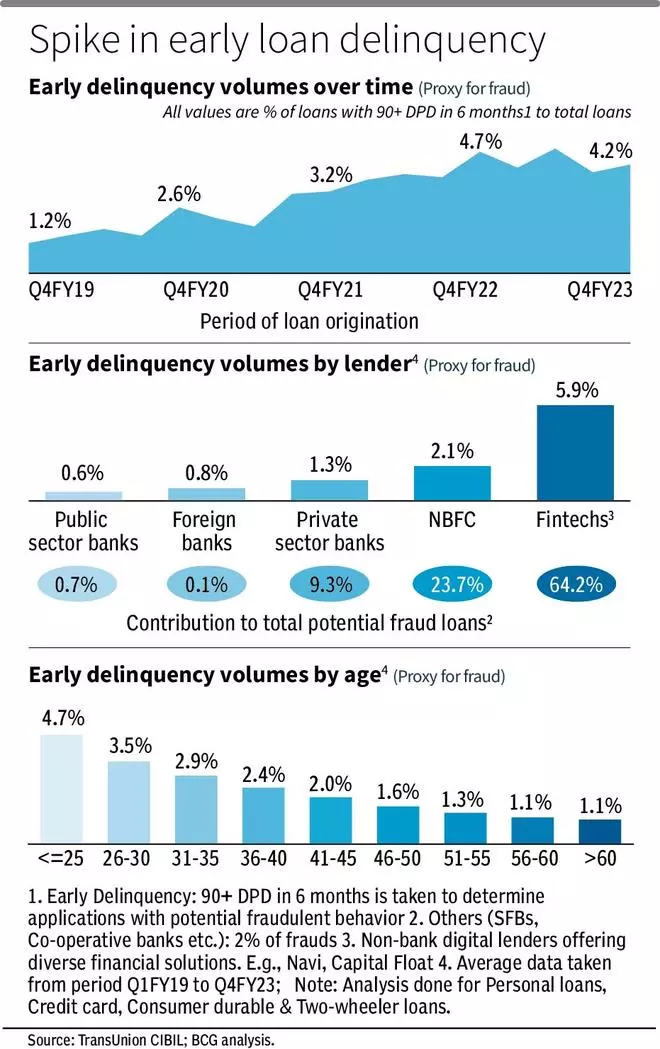

Spike in early delinquency of loans, primarily in younger age groups and for unsecured loans, suggest a need for higher focus on application fraud control, according to a BCG report.

Early delinquency of loans has risen from 1.2 per cent of loans that are 90+ days past due (DPD) in six months of disbursement to total loans in the fourth quarter (Q4) of FY19 to 4.2 per cent in Q4FY23

Early delinquency of loan, which is 90+ DPD in 6 months, is taken to determine applications with potential fraudulent behaviour.

“Lenders have predominantly focused on predictive credit models in retail lending. While fraud control units exist, the analytical rigor of typical lenders is usually reserved for credit risk.

“Thus, fraud control efforts are limited to high-touch, judgmental, or rule-based investigations. At times, it is reactive and involves post-disbursement hindsight,” per the report “Banking for a Viksit Bharat”, put together by a team, including Ruchin Goyal and Hardik Shah, Managing Director and Senior Partners at BCG..

“With the incidences of early delinquencies (proxy for frauds) rising – primarily in younger age groups and for unsecured loans, fraud control needs to change from reactive, high-touch, and judgmental action

Fraud behaviours

The authors noted that leverage build-up and potential fraud behaviors are increasing rapidly in select segments.

Early delinquency volumes by lender show that fintechs have the highest percentage (5.9 per cent) of loans that are 90+ DPD in six months of disbursement to total loans, followed by non-banking finance companies (2.1 per cent), private sector banks (1.3 per cent), foreign banks (0.8 per cent) and public sector banks (0.6 per cent), per BCG’s analysis.

Early delinquency volumes by age show that those in the less than or equal to 25 years have the highest delinquency at 4.7 per cent. This declines with age.

“Limited sophistication in fraud risk management has seen a rising trend of delinquencies which may have an element of application fraud. Moreover, by most indications, loan applications with traits of potential fraudulent behavior may have loss levels that are more likely to be underestimated than overestimated,” the authors said.

They cautioned that as digital lending increases, fraud detection capabilities need to evolve – it needs to be more pro-active driven by patterns analytics, and unified through common industry protocols/ utilities.

“Collections function across lenders need to be transformed – fraud analytics, sharper risk segmentation, and collections personalisation are required to optimise the ‘Cost and Loss’ equation,” the report said, even as it emphasised the importance of leveraging data and advanced analytics for credit and fraud models – to drive faster credit penetration.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.