The funds mobilised by India Inc through the IPO route in this financial year was up 19 per cent to ₹61,000 crore compared to ₹52,116 crore raised in FY23.

- Also read:Why India Inc is slow to adopt AI tech

However, excluding the mega LIC IPO of ₹21,000 crore in May 2022, the mop-up increased to 58 per cent year-on-year, according to Prime Database.

Given the buoyancy in the economy, 75 companies hit the primary market compared to 37 in FY23. The average deal size reduced significantly to ₹815 crore in this fiscal from ₹1,409 crore in FY23 due to more number of companies tapping the market.

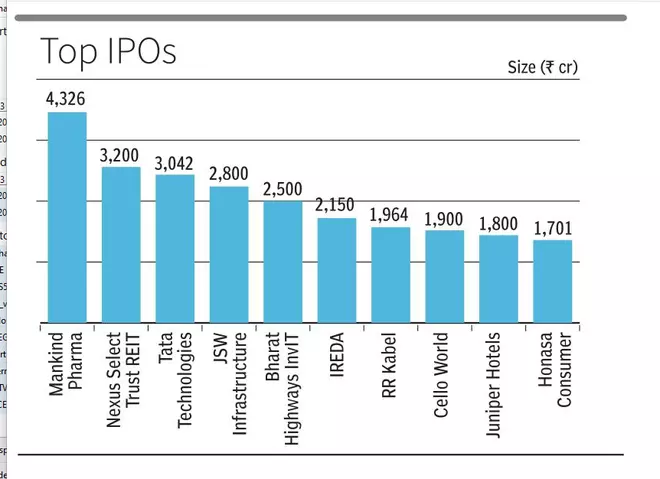

Among the mainboard IPOs, Mankind Pharma was the largest with ₹4,326 crore, followed by JSW Infrastructure at ₹2,800 crore. The smallest IPO was that of Plaza Wires, which raised ₹71 crore.

Average listing gains

With the key benchmark indices hitting a new high, the average listing gains rose to 29 per cent in FY24 against 9 per cent in the previous financial year.

Of the 75 IPOs, 48 delivered a return of over 10 per cent. Vibhor Steel delivered the biggest return of 193 per cent on debut, followed by BLS E-Services (175 per cent) and Tata Technologies (163 per cent). Over 50 of the 75 IPOs are currently trading above the issue price with an average return of 65 per cent.

Pranav Haldea, Managing Director, Prime Database Group, said of the 75 IPOs that hit the market, 54 issuances were subscribed over 10 times, out of which 22 IPOs were subscribed more than 50 times while 11 IPOs were subscribed more than three times. The other 10 IPOs were oversubscribed between 1 and 3 times.

The response of retail investors was also higher compared to the previous financial year. The average number of retail applications rose to 1.3 million from about 0.6 million in the previous financial year. Tata Technologies, the first Tata Group IPO in two decades, saw the highest number of retail applications with over 50 lakh, followed by DOMS Industries (41 lakh) and INOX India (37 lakh).

In FY24, 96 companies filed their offer documents with the market regulator SEBI compared to 75 in the previous financial year. However, 37 companies planning to raise ₹59,000 crore let their approval lapse, while two looking to raise ₹1,000 crore withdrew their documents. SEBI returned the offer documents of five looking to raise ₹2,500 crore.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.