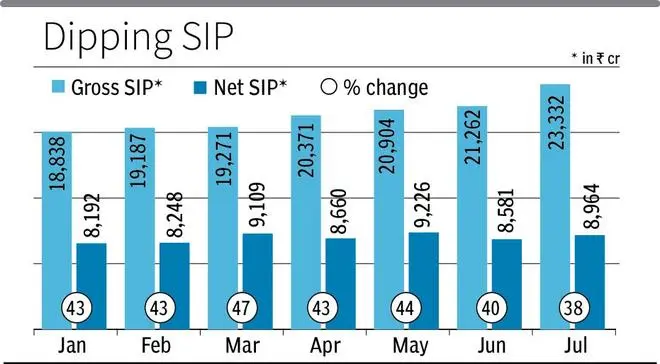

Notwithstanding the bullish sentiments around mutual funds’ systematic investment plans, the ratio of net to gross SIP has plunged 9 percentage points to 38 per cent against 47 per cent in March.

While the gross SIP inflows have touched a new high of ₹23,332 crore last month, the net inflows accounted only for 38 per cent or ₹8,964 crore as many of the recent entrants pressing the pause button due to sharply volatility amid growing economic uncertainty.

In contrast, the net SIP inflows at ₹9,109 crore accounted for 49 per cent of gross inflows at ₹19,271 crore in March.

Though the bellwether Sensex hit a new high at 81,741 points last month from 73,651 points in March, it remained volatile to touch a low of 73,961 points in May before recovering to 79,032 in June.

Anxious investors

Akshat Garg, AVP, Choice Wealth, said as markets touch all-time highs, investors tend to redeem their investments or pause SIPs, driven by fears of an impending market correction or a desire to book profits at perceived peak valuations.

During market peaks, he said some investors choose to build cash reserves by temporarily halting their SIPs, aiming to accumulate liquidity for future investment opportunities.

Ankur Punj, Managing Director, Equirus Wealth, said a lot of retail investors who have started SIPs over the past few years are often impatient for higher returns and end up entering the market at peak and exiting at its low.

Saving for short-term goals, he said aspirational retail investors tend to switch from one top performing scheme to another and frequently pause or stop SIPs to meet their expenses.

Rahul Ghose, CEO, Hedged.in, said there has been a series of looming threats right from global geo-political threat to domestic issues with questions being raised against the regulator.

Moreover, the market has rallied in the last eight months without any meaningful time and price correction which the market participants are expecting soon, he said.

“Pausing SIP might not be a correct solution for any of the problems. Markets although according to us is in its last leg of rally which can last another 1000 points,” he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.