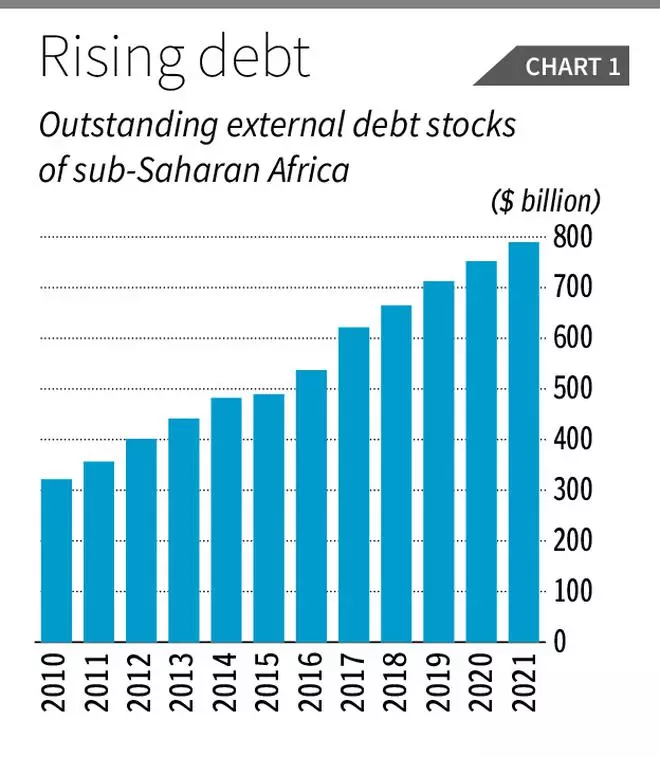

Ghana’s recent default on its external debt service commitments amplifies the signal that external debt in sub-Saharan Africa has reached unsustainable levels. The stock of outstanding external debt of sub-Saharan countries, which stood at $322 billion in 2010, had risen to $790 billion by 2021 (Chart 1).

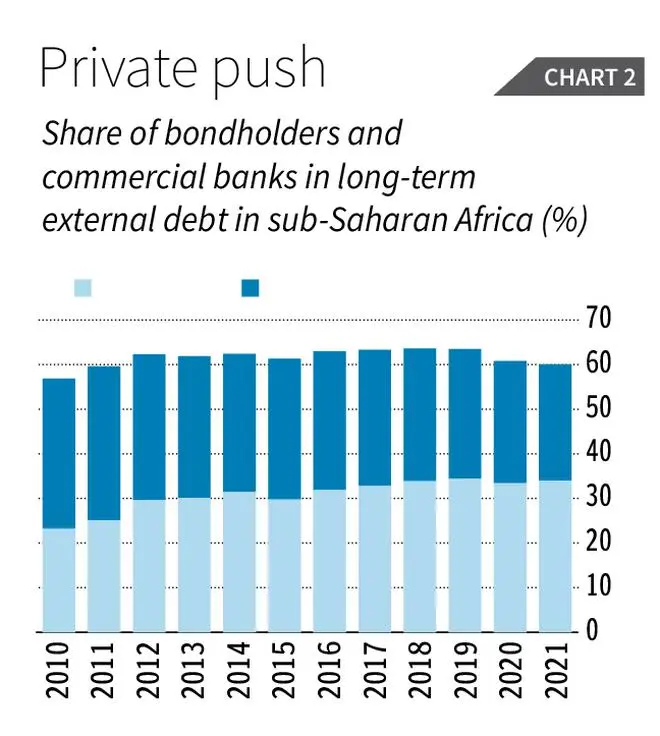

This debt is not just owed to official bilateral or multilateral creditors. Over the decade starting 2020, private creditors (with no public guarantee) have consistently accounted for a quarter or more of the stock of that debt. The share of private bondholders and commercial banks amounted to 60 per cent of long-term external debt of countries in the region. In that private debt, the share of bondholders had increased from 23 per cent in 2010 to 34 per cent by 2021 (Chart 2).

These numbers are surprising given the fact that for a long period (in fact much longer than was the case with the larger and more developed “emerging markets”), private lenders had considered Africa’s “frontier markets” too risky to enter.

Two initiatives

Moreover, these poorer frontier countries, especially in Africa, had experienced a debt crisis in the 1990s and again thereafter. This led to two initiatives — the Highly Indebted Poor Countries (HPIC) Initiative of 1996 and the more far-reaching Multilateral Debt Relief Initiative (MDRI) of 2005 — aimed at providing debt relief to lower their external debt levels and reduce their external debt servicing. These were linked to conditions and promises that they would desist from accumulating similar unsustainable levels of external debt in future.

The HIPC Initiative was instituted by the IMF and the World Bank, whereas the MDRI was an initiative of the 22 developed country members of the Paris Club of creditors. Of the 36 low-income poor countries that had been identified as potential beneficiaries of the MDRI, 29 were from Africa. Debt relief under the two initiatives was projected to reduce the debt stocks of 26 African countries by more than 90 per cent. Debt growth was to be curtailed through suitable adjustment measures and a dominant share of debt incurred was to be in the local currency. Partly as a result of these initiatives, the median external debt-to-GDP ratio of countries in sub-Saharan Africa had declined to levels far below those at which they had been identified as debt stressed.

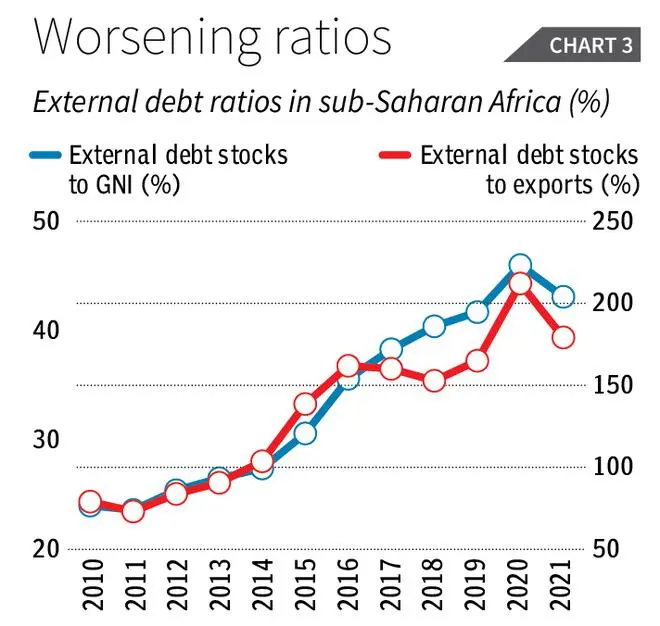

However, within a few years it was evident that the most important objective of the debt reduction initiative would not be achieved. The ratio of external debt stocks to Gross National Income (GNI) rose from 24 per cent in 2010-11 to 31 per cent in 2015 and 43 per cent in 2021 (Chart 3).

This was because, even if the debt reduction initiative was a signal that these countries were prone to debt stress, rapid debt growth continued for two reasons. The first was a change in the attitude of private creditors, induced by developed country monetary policies that resulted in a surge in global liquidity after the 2008 financial crisis. As a consequence, the presence in Africa of private bondholders in search of high yields increased significantly, especially after 2010. To these investors, the debt reduction initiatives instead of being taken as signals that sub-Saharan countries were prone to default and therefore too risky, were measures that had “de-risked” those markets. In a world awash with liquidity, this made them stand out as potential targets for investment.

China’s entry

The second development driving debt growth was the entry into the scene of China as a major new bilateral creditor. China’s share in sub-Saharan debt stocks rose from 2.2 per cent in 2010 to 11.2 per cent in 2016, and stood at 10.1 per cent in 2021. Notably, this was still lower than the 60 per cent share held by bondholders and private banks, and also lower than the 19 per cent share in 2021 of multilateral creditors in total debt.

Thus, two supply side factors have played a role in putting sub-Saharan Africa in its current difficult position. The flows of both multilateral and private debt rose, such that their share either remained stagnant or increased. And while bilateral credit flows from some Paris Club members declined, China entered the scene and increased its share, contributing to the relative stability of the share of official credit in total external debt stocks. Overall, there was no end to the rush of lenders, especially private lenders, into the so-called “frontier markets” in the continent, despite the debt crisis of the 1990s and early 2000s.

Many sub-Saharan governments opted to exploit the opportunity of the availability of credit, despite the experience with the debt crisis. Debt stocks rose at a rate much faster than the rise in national income and remained in excess of the sums required to finance even the current account deficit.

One factor facilitating this return to high debt levels was the rise in commodity prices in a “super cycle” lasting through the first decade-and-a-half of the current century. That rise was driven partly by factors from the demand side: the rising demand for agricultural and metallic raw materials from a rapidly growing China, and the rising demand for edible oils resulting from changed consumption patterns in the developing countries in general. But speculative intervention by financial and trading capital also contributed to price increases in no small measure.

Commodity boom ends

As was to be expected, the commodity price boom had to and did come to an end by around 2015. That obviously weakened the capacity of the highly indebted countries in sub-Saharan Africa to service their debt. The Covid pandemic and its damaging impact on economic performance and foreign exchange earnings transformed that weakness into incapacity.

The difficult external circumstances were subsequently worsened by a sharp rise in the cost of imports of fuel and food in the aftermath of the Ukraine war and the speculative activity it triggered, a rise in global interest rates and a reversal of capital flows precipitated by the anti-inflationary monetary policy stance of advanced country central banks, and a strengthening of the dollar because of the flow of capital into safe dollar-denominated assets.

The result is the current debt crisis. The message this crisis sends is that the structural weaknesses that made these countries prone to debt stress were left unaddressed in the debt-relief packages of the early 2000s. Any future attempts to ensure finance for future development and environmental and climate alleviation needs cannot afford to ignore these structural concerns.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.