The rupee has crossed the 80 mark against the US dollar. It has been sliding in the last five months, ever since the war broke out in Ukraine and the US Fed, in parallel, began aggressive action in response to emerging inflation trends. Each month the rupee crossed a new mark — 75 in January, 76 in March, 77 in May, 78 in June and 79 in July. And the rupee touched 80 in July itself, rather than August. How is one to read this trend?

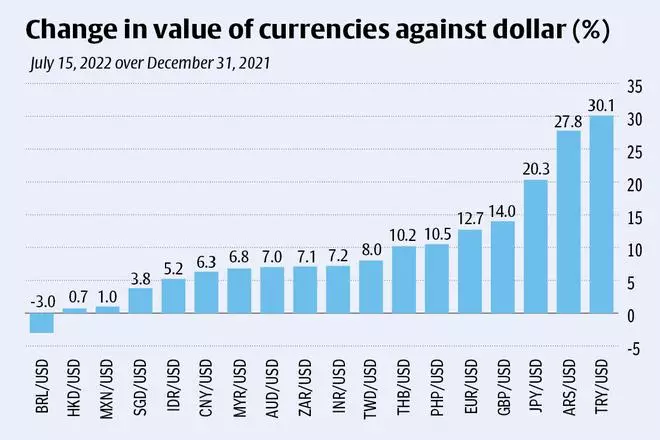

The important thing is the rupee is not alone in this spiral; almost all currencies are witnessing similar trends. In fact, if one were to look at a point to point change — July 15, 2022 over December 31, 2021 — in value of currencies across the world, the rupee has not really done that badly. It has gone down by around 7.2 per cent, which is just about the median level compared with other currencies (see Chart).

The currencies of China, Malaysia, South Africa and Australia have done better but still fallen by around 6 per cent, while those of Indonesia, Singapore, Hong Kong, Brazil and Mexico have dropped less than 6 per cent.

However, the rupee had appreciated in effect against the euro, pound and yen and did better than the currencies of Taiwan and Thailand. Therefore, the current spate of depreciation is more of a global phenomenon. The rupee is somewhere in the middle, which is comforting.

But this should not divert attention from the fact that the rupee has also been hit by weakening fundamentals, such as a widening trade deficit which will expand further as growth picks up. India is definitely one of the faster growing economies. However, this also means that demand for imports, both oil and non-oil, will increase which will reinforce the trade deficit.

Exports, on the other hand, tend to be guided more by global growth conditions and if there is a slowdown here, there would be an adverse impact. It has been observed historically that exports tend to be influenced more by global growth than exchange rate changes. This is why the trade deficit is expected to widen leading to also a larger current account deficit which is expected to cross the 3 per cent mark this year.

RBI’s initiatives

The obvious question to ask is whether or not the RBI can do anything about it. In a system of free trade and general openness to convertibility, central banks will be constrained and cannot do much to restrict outflows. What can be done through policy has already been done by the RBI, in terms of allowing more NRI deposits, ECBs (external commercial borrowings) and FPIs (foreign portfolio investments). It is however debatable whether these measures will help bring about a turnaround in forex inflow; it can, at best, increase marginally.

For example, ECBs today are no longer attractive, with interest rates overseas increasing. Add to this the foreign currency risk, which is high in these volatile times, and domestic borrowing may be preferred for most companies. Taking forward cover, which is advisable, has a cost and the economics may not make it favourable to do so.

Similarly, allowing higher interest rates on NRI deposits is a good regulatory move. But with deposit rates increasing in the West, savers will see this as an option which may not be significantly more attractive. FPIs were not too interested in corporate paper to begin with, as seen by the relatively small proportion of the limits being utilised. Presently, it is just 18 per cent of the limit permitted. Hence, allowing them to go for short-term investments of less than one year maturity could work only at the margin. But the RBI has surely been proactive in this regard from the point of view of policy.

The phenomenon of currency depreciation is a global problem brought about by the sudden strengthening of the dollar. This may not prevail for long periods; at present, low unemployment and high interest rates signal the strength of the US economy. But as the Fed rate hikes feed into the system and slow down growth, the dollar should weaken and there would be some respite for other countries.

Therefore, trying to arrest the slide in the rupee may not be very meaningful. Using reserves to stem the fall may just mean using up resources with no medium term gain. At the same time, it is essential to ensure that there is no free fall which would be the case in the absence of selective intervention by the RBI.

Handle reserves carefully

The RBI has seen reserves come down by $35 billion over March and are at around $573 billion due to both regular intervention as well as revaluation effects on holdings of non-dollar assets.

Direct intervention through sale of dollars hence has limits. Imports in the first quarter were around $190 billion, which at a monthly average of $60-63 billion would amount to nine months of forex cover for imports, down from 13-14 months last year.

Therefore, while the reservoir looks adequate, management of the same is imperative so that they do not fall below threshold levels determined by the central bank. Therefore, direct intervention would have to be only the last resort.

The RBI has already used the policy tools to widen the circumference for capital flows, and the benefits would evolve over a period of time. Under these conditions there may not be too much that can be done. Intervention in the forwards market can be used to align the movements to other currencies so that the rupee remains in the middle range of depreciation. As long as interest rates rise in the West and the easy money which came about due to the quantitative easing is reversed, currencies will keep declining. It may be best to avoid any aggressive interventions from hereon.

The writer is Chief Economist, Bank of Baroda. Views are personal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.