We are far from realising our goal of manufacturing GVA reaching 25 per cent of the gross value added for the economy as a whole. This is despite several policy steps having been taken, such as: easing investment flow and access to technology, removal of capacity constraints, creating growth centres and industrial clusters, PLI and other measures. At constant prices from 2011-12 to 2021-22, manufacturing GDP has remained stagnant at around 17 per cent. At current prices it has gone down from 17.4 per cent to 14.5 per cent. We have a structural problem in manufacturing. Let us see why it is so.

Structural issues

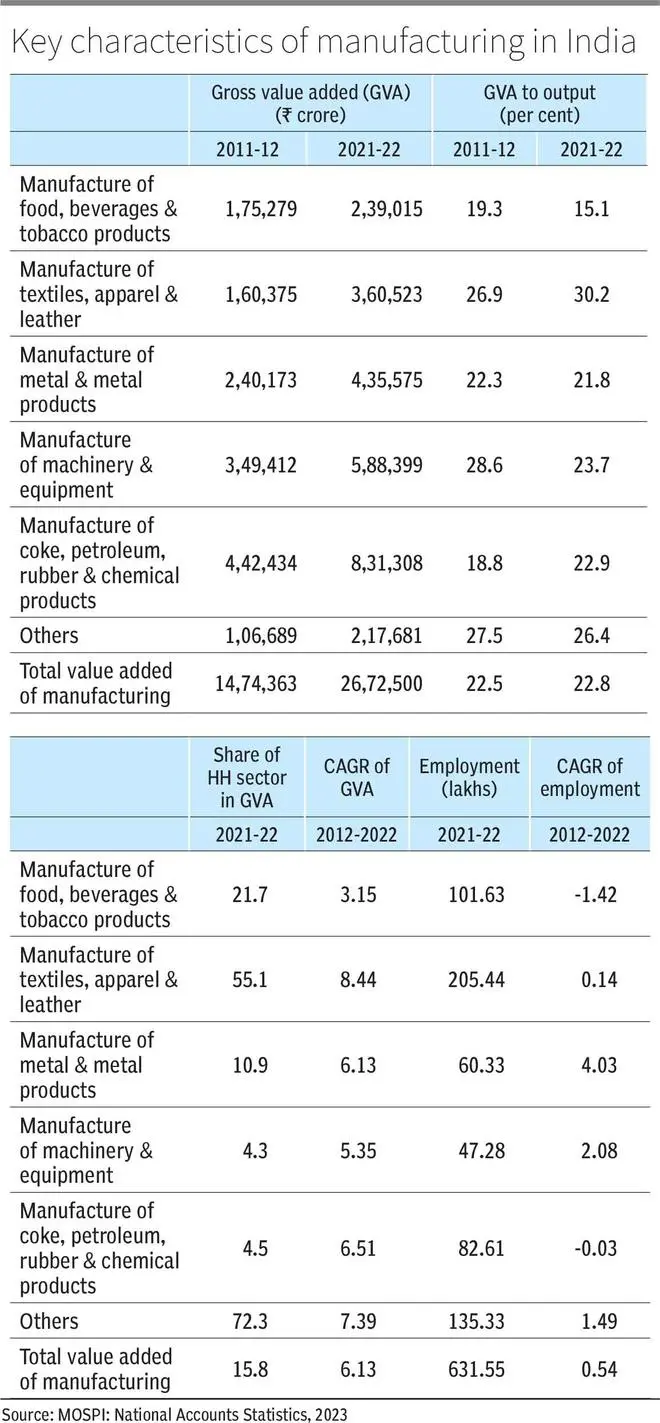

An analysis of sectors shows up a state of stagnation with some areas which have bucked the trend. A series of indicators highlight the pain points. Generally speaking, these are: low scale, low capital intensity and low share of labour in value added.

Sectors which have a high GVA to output, or those which have been competitive over time, are metals and machinery, petroleum and chemicals and textiles, apparel and leather. Employment growth across sectors is varied, though (see table).

In the case of textiles, the household sector (small enterprises including own account enterprises) dominates the output scene. Given the fact that the share of textiles in private consumption expenditure has increased, it is clear that this sector has immense potential to generate employment across regions. It should be an area of engagement for policymakers.

Indeed, linked to the employment scenario is the contribution of factors of production to value added. According to Annual Survey of Industries (ASI) data, 56 per cent of value added comes from profits and depreciation. The allocation of value added to labour is less than 25 per cent. In terms of output, the share of labour is less than 5 per cent. This shows that there is hardly any in-house R&D and skill development. Empirical evidence shows that a huge technology gap exists in high precision equipments, heavy duty machine tools, underground mining equipments. We are clearly stuck in our R&D thanks to our collective lack of effort.

The inter-industrial stickiness in the share of manufacturing of various sectors indicates a state of stagnation. Evidence reveals that the number of active foreign companies in manufacturing has declined (CMIE and government data). The number of new foreign companies has also declined in the past five years. We need to strain ourselves to attract manufacturing supply chains. The latest push to attract investment as a part of ‘China plus one’ could make a difference over time.

According to MoSPI, the overall capital formation in manufacturing for patents property rights at ₹1.34-lakh crore in 2021-22 was less than 4 per cent of the value added in manufacturing. In terms of output, this ratio is down to below 1 per cent. Indian manufacturing, therefore, continues to remain resource intensive, job work based and operating on a given technology, as sourced, without much of updating or improvement. This is despite the fact that certain sectors have graduated to high-tech industries.

Lack of scale

As is generally accepted, manufacturing in India suffers from lack of scale. Generally speaking, higher capital intensity leads to a higher GVA to output ratio, although that is not always the case; textiles is an exception.

But there is a caveat here. Factories with higher capital intensity dominate the Indian manufacturing scene, creating an oligopolistic production structure that is not innovative; it is also restrictive.

Factories with investment exceeding ₹1,000 crore dominate the Indian manufacturing scene, accounting for 74 per cent of output, 76 per cent of value added, 55 per cent of persons employed and 85 per cent of invested capital. These industries seem keen to operate under supply scarcity. A striking feature is skill shortages across the sectors. A decline in the growth in value added at constant prices from an average of 8.3 per cent for a long period of 1980-2011 and its subsequent moderation to an annual growth of 5.2 per cent during 2011-12 to 2019-20 (ASI data) indicate that manufacturing mindset is yet to become global in terms of scale.

In order to raise GVA in manufacturing, there should be a logistics cost reduction of 13 per cent to 7.5 per cent of GDP. There should be a coordinated effort to facilitate efficient labour intensive manufacturing in parts of the country where labour is available and increase female LFPR to 45 per cent. Stability in tax laws and tax administration, ease of doing business improvement, entering into calibrated FTAs to develop supply chains and massive skill development efforts are needed.

Gopalan was Secretary, Department of Economic Affairs, and Singhi is a former Senior Economic Adviser, Ministry of Finance

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.