India is home to over 63 million MSMEs, employing 111 million people, and contributing nearly 30 per cent of the country’s GDP.

The micro, small and medium enterprises (MSMEs) stood strong during the Covid-19 pandemic and emerged resilient with new learnings.

A NeoGrowth study evaluates the preparedness and expectations of India’s MSME owners as they step into 2023 amidst global volatility.

Here are 4 charts that tell the story.

The MSME Business Confidence Study was conducted nationwide with responses from close to 3,000 MSME owners. It aimed to cover the expectations of India’s MSME owners across over 25 cities and over 70 business segments

Consumer charm

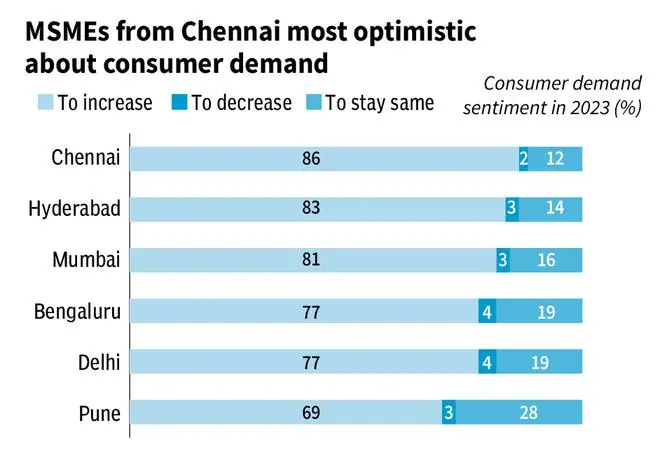

71 per cent of MSME owners expected an increase in consumer demand in 2023, while 21 per cent of MSME owners felt it would remain the same and only 4 per cent of MSME owners anticipated that it would decrease.

MSME owners in Chennai showed the highest optimism with around 86 per cent expecting growth, followed by 83 per cent in Hyderabad and 81 per cent in Mumbai.

In terms of industry segment, MSME owners in the retail and trading segment said they were positive about a strong consumer demand in the new year. Women-led MSMEs from the trading and wholesale industry anticipated a healthy consumer demand in the coming year compared to other respondents.

Eye on profits

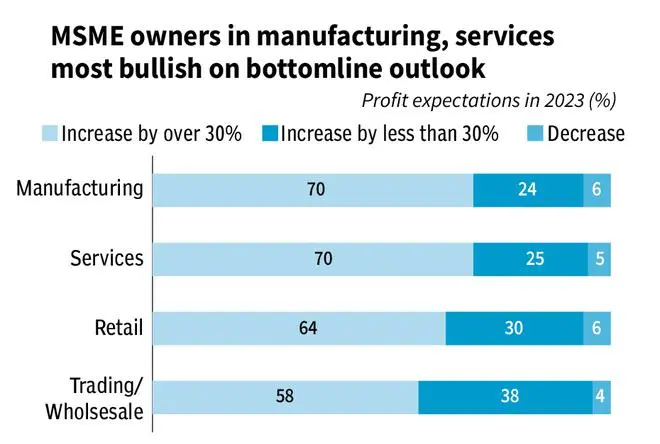

96 percent of MSME owners expected their profits to increase in 2023. Out of these, 66 per cent anticipated profits to rise by over 30 per cent, while 30 per cent of MSMEs felt that it would increase by less than 30 per cent and 4 per cent of the MSMEs surveyed expected business profitability to decrease.

MSMEs in Chennai were most confident about profitability in 2023 with 80 per cent expecting an over 30 per cent increase in profits. In contrast, the profit expectations of MSME owners in Mumbai and Pune were conservative.

According to a FICCI report, the average capacity utilisation in manufacturing is at over 70 per cent, pointing towards an uptick in economic activity. The NeoGrowth study reveals that 70 per cent MSME owners in manufacturing and services segments expect their profits would rise by more than 30 per cent.

Credit demand

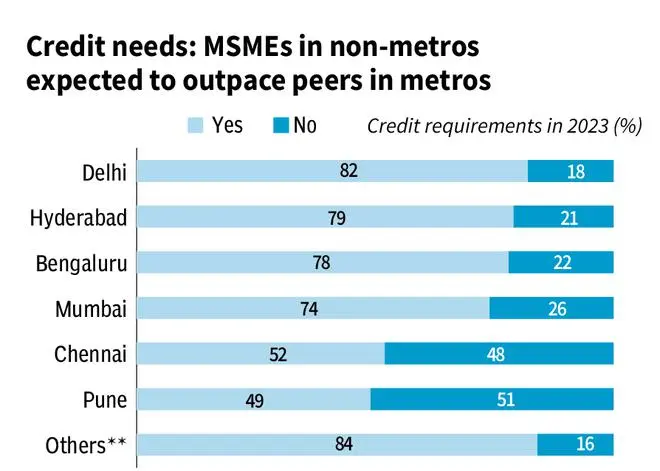

84 per cent of MSMEs in non-metros, largely bucketed under ‘others’ in the study, said they planned to opt for business loans in 2023.

The accelerated demand for credit from smaller cities signalled MSMEs’ business recovery as they require funds for their working capital needs, growth and expansion.

The manufacturing and services industry segments anticipated higher credit demand.

Over 80 per cent of women MSME owners expected to opt for a business loan in 2023.

Given the expectations of a strong consumer demand, the repo rate increase by 225 basis points since early 2022 was unlikely to impact the MSME credit demand in 2023.

Digital push

60 per cent of MSME owners said they planned to step up technology or digital investments in 2023.

The willingness for digital adoption was clearly evident with 38 per cent of MSMEs said that they would focus on online selling, 23 per cent of the owners planning to build a social media presence, and 24 per cent of MSMEs desiring to digitise their accounts and payments to track cash flows in 2023.

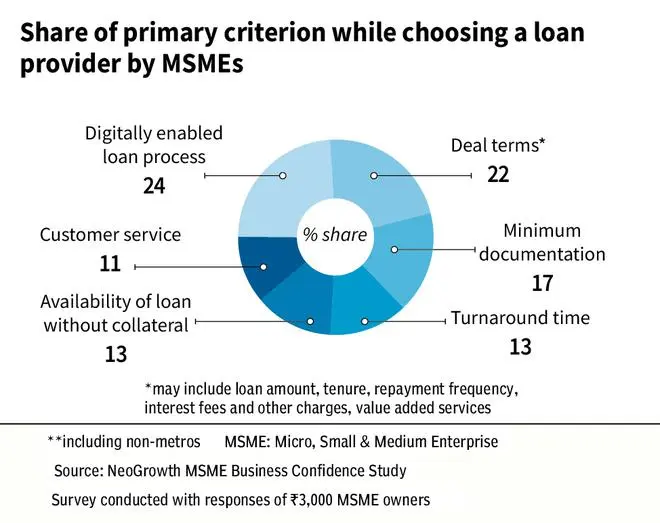

MSMEs considered digitally enabled processes, deal terms and minimum documentation as the primary criteria while choosing a lender.

61 per cent of the MSME owners said that they intend to expand their workforce in 2023 with higher hiring expected in the services and manufacturing industry segments. Three out of four Chennai-based MSMEs planned to hire more employees in 2023, the highest in the country.

71 per cent of MSME owners hoped to incorporate sustainable business practices into their businesses in 2023. ‘Elimination of plastic usage’ has stood out as one of the most preferred on the list of sustainable business practices that included energy conservation/ renewable energy, tree plantation, reducing carbon emissions, reducing plastic and paper usage and controlling/ reducing air/ water pollution.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.